Question:

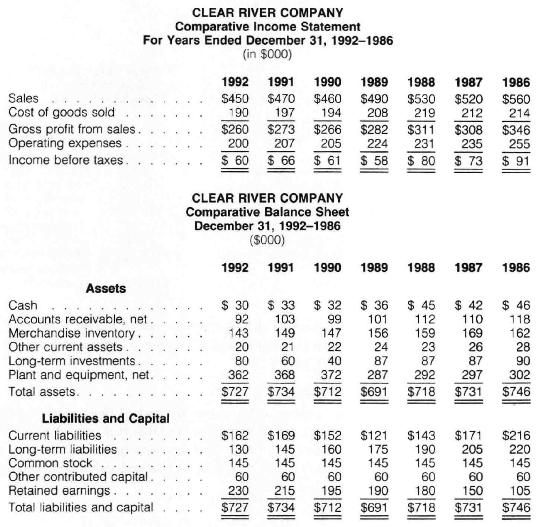

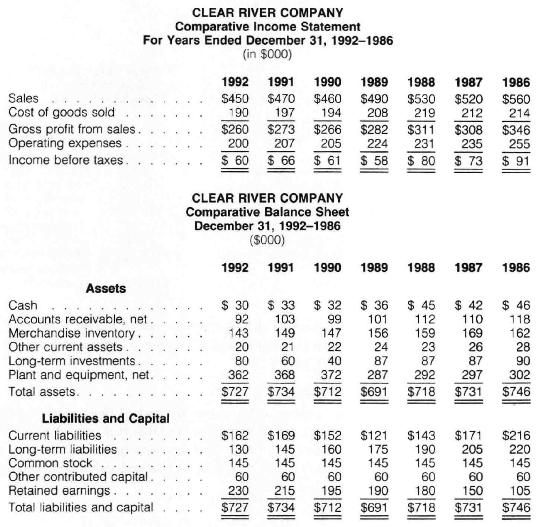

The condensed comparative statements of Clear River Company follow:

\section*{Required}

1. Calculate trend percentages for the items of the statements using 1986 as the base year.

2. Analyze and comment on the situation shown in the statements.

Transcribed Image Text:

CLEAR RIVER COMPANY Comparative Income Statement For Years Ended December 31, 1992-1986 (in $000) 1992 1991 1990 1989 1988 1987 1986 Sales $450 $470 $460 $490 $530 $520 $560 Cost of goods sold 190 197 194 208 219 212 214 Gross profit from sales. $260 $273 Operating expenses. Income before taxes. 200 207 $ 60 $ 66 $ 61 CLEAR RIVER COMPANY Comparative Balance Sheet December 31, 1992-1986 ($000) $266 205 $282 $311 $308 $346 224 231 235 255 $ 58 $ 80 $ 73 $ 91 1992 1991 1990 1989 1988 1987 1986 Cash Assets Accounts receivable, net. Merchandise inventory. Other current assets. Long-term investments. Plant and equipment, net. $ 30 $ 33 $ 32 $ 36 $ 45 $ 42 $ 46 92 103 99 101 112 110 118 143 149 147 156 159 169 162 20 21 22 24 23 26 28 80 60 40 87 87 87 90. 362 368 372 287 292 297 302 Total assets. $727 $734 $712 $691 $718 $731 $746 Liabilities and Capital Current liabilities $162 $169 $152 $121 $143 $171 $216 Long-term liabilities 130 145 160 175 190 205 220 Common stock 145 145 145 145 145 145 145 Other contributed capital. 60 60 60 60 60 60 60 60 Retained earnings. 230 215 195 190 180 150 105 Total liabilities and capital $727 $734 $712 $691 $718 $731 $746