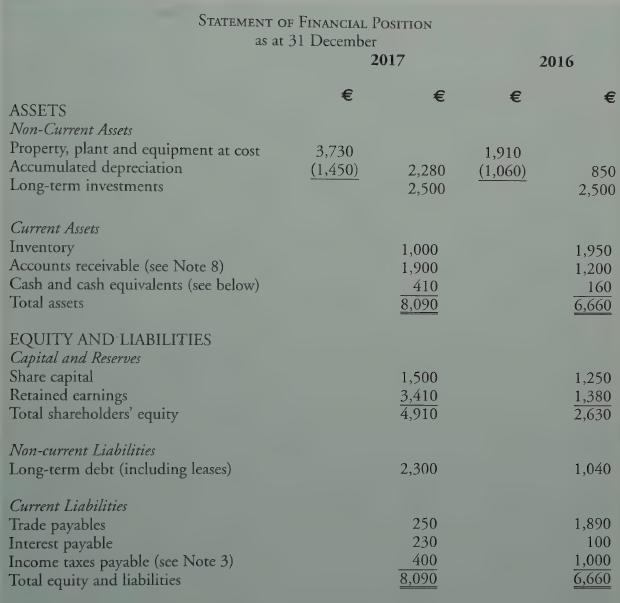

The draft financial statements of CCE Limited for the year ended 31 December 2017 are as follows:

Question:

The draft financial statements of CCE Limited for the year ended 31 December 2017 are as follows:

Cash and cash equivalents at 31 December are made up as follows:

Notes to draft financial statements:

1. Interest expense was €400, of which €170 was paid during the period. €100 relating to interest expense of the prior period was also paid during the period. €200 of interest was received during the period.

2. Dividends paid were €1,200.

3. The liability for tax at the beginning and end of the period was €1,000 and €400, respectively.

4, During the period, a further €15 tax was provided for. Withholding tax on dividends received amounted to €105, thus leading to the total tax expense of €120.

5. During the period, CCE Limited acquired property, plant and equipment with an aggregate cost of €1,900, of which €900 was acquired by means of a lease that resulted in the recognition of a right-of-use asset. Cash payments of €1,000 were made to purchase property, plant and equipment.

6. €90 of capital repayment was paid under the lease referred to in Note 5.

7. Plant with an original cost of €80 and accumulated depreciation of €60 was sold for €20.

8. Accounts receivable as at the end of 2017 include €100 of interest receivable.

9. €250 was raised from the issue of share capital and a further €450 was raised from longterm borrowings.

Requirement

(a) Prepare a statement of cash flows for the year ended 31 December 2017 using the indirect method in accordance with the illustrative format in IAS 7 Statement of Cash Flows.

(b) Show the calculation of cash flows from operating activities using the direct method.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly