The draft statements of financial position of Nip Limited (Nip) and Tuck Limited (Tuck) as at 31

Question:

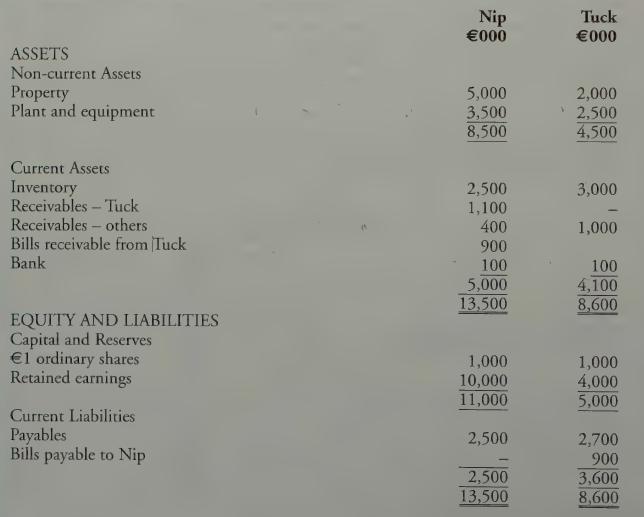

The draft statements of financial position of Nip Limited (“Nip”) and Tuck Limited

(“Tuck”) as at 31 December 2017 are as follows:

Additional Information:

1. On 1 January 2017, Nip issued 900,000 €1 ordinary shares with a market value of €5 per share in return for 900,000 €1 ordinary shares in Tuck when the balance on Tuck’s retained earnings was €3,000,000. On that date, the book value and fair value of net assets were the same, except that the property that had a book value of €2,200,000 was valued at €2,700,000. The revaluation has not been incorporated into the books of Tuck. Depreciation is 10% per annum on book value. The investment in Tuck has not yet been incorporated into the books of Nip. With respect to the measurement of noncontrolling interests at the date of acquisition, the proportionate share method equates to the fair value method.

2. The inventory of Tuck includes items purchased from Nip for €1,250,000. Nip had made a profit of 25% on cost in respect of these items.

3. One of the products manufactured by Nip has been sold below its cost during the year ended 31 December 2017. Consequently, the directors believe that the plant and equipment used to manufacture this product have suffered a permanent diminution in value.

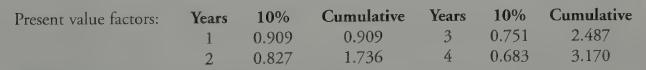

The carrying value, at historical cost, of the plant and equipment at 31 December 2017 is €400,000 and the net realisable value is estimated to be €200,000. The anticipated net cash inflows from this product are expected to be €100,000 per annum for the next four years. (A market discount rate of 10% per annum should be used in any present value computations.)

4. During the year ended 31 December 2016, three people died using machinery manufactured by NIP. Legal proceedings were started in 2016, but Nip did not provide for potential damages at 31 December 2016 on their lawyers’ advice that it was unlikely NIP would be found liable. However, by 31 December 2017, Nip’s lawyers believe that, owing to developments in the case, it is probable that NIP will be found liable for damages of approximately €2,000,000.

Requirement Prepare the consolidated statement of financial position of Nip Group as at 31 December 2017.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly