The draft statements of profit or loss and other comprehensive income of Ark Limited (Ark), Boat Limited

Question:

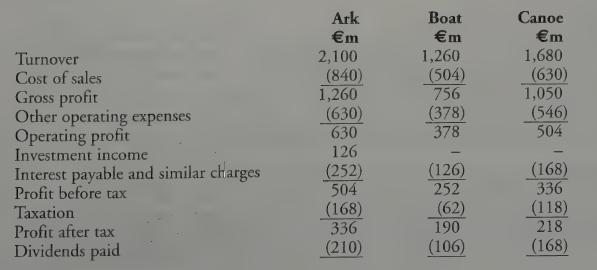

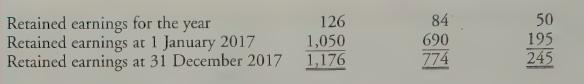

The draft statements of profit or loss and other comprehensive income of Ark Limited (“Ark”), Boat Limited (“Boat”) and Canoe Limited (“Canoe”) for the year ended 31 December 2017 are as follows:

Additional Information:

1. On 1 January 2011, Ark purchased 160 million €1 ordinary shares in Boat for €500 million. The net assets of Boat at 1 January 2011 comprised:

€m €1 ordinary shares 200 Retained earnings 23 329 There was no difference between the book value of Boat’s net assets and their fair value at 1 January 2011.

2. On 1 July 2017, Ark purchased 180 million €1 ordinary shares in Canoe for €458 Million.

The net assets of Canoe at 1 January 2017 comprised:

€m €1 ordinary shares 240 Retained earnings 195.

435 There was no difference between the book value of Canoe’s net assets and their fair value at 1 July 2017.

3. On 1 July 2017, Ark sold its entire investment in Boat for €950 million in cash, incurring a tax liability of €50 million in connection with the sale. Ark has not yet accounted for the effects of the sale. On 1 July 2017, the goodwill arising on the acquisition of Boat was carried at €32 million. (Note: the disposal of subsidiaries is dealt with in Chapter 32.)

4. In December 2017, Ark sold raw materials to Canoe for €30 million, making a profit of €10 million. These raw materials are included at invoice value in the inventory of Canoe at 31 December 2017.

5. It is group policy to charge all of any profit or loss arising on intragroup sales against group retained earnings. “

co N a4 isa Ss = x a0)

©)

|

2)

Z Ss FY n ea] ej Requirement Prepare the consolidated statement of profit or loss and other comprehensive income of Ark Group for the year ended 31 December 2017, starting with profit before tax and ending with retained earnings at 31 December 2017, having regard to the fact that Ark does not propose to publish its own statement of profit or loss and other comprehensive income.

Note: you may assume that transactions accrue evenly throughout the year.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly