The following information has been extracted from the financial statements of Earno ple for the year ended

Question:

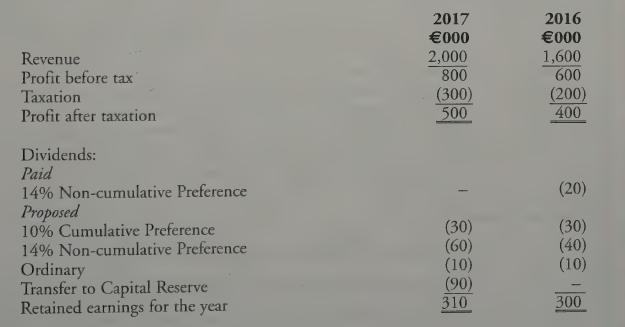

The following information has been extracted from the financial statements of Earno ple for the year ended 31 December.

The 14% preference dividend paid in 2016 is in respect of previous years. The proposed dividends in 2016 and 2017 were approved by shareholders of Earno ple during the year ended 31 December 2016 and 2017 respectively. Earno plc has issued ordinary share capital of 100,000 @ €1 each. The preference dividends have not been charged in arriving at profit after tax.

Requirement Each of the following questions should be considered independently of one another.

(a)oBasic.EPS.

Calculate the basic EPS for both years.

(b) Issue at Full Market Price.

Assuming that Earno plc had issued 5,000 ordinary shares on 31 March 2017 at full market price, calculate the basic EPS for both years.

(c) Capitalisation/Bonus/Scrip Issue.

Assuming that on 31 May 2017 Earno plc issued 1 ordinary share for every 5 already held, calculate the basic EPS for both years.

(d) Share Exchange.

Assuming that on 30 April 2017 Earno plc issued 10,000 ordinary shares as consideration for the acquisition of a subsidiary company, calculate the basic EPS for both years.

(ce) Rights Issue for less than Full Market Price.

Assuming that on 30 June 2017 (market price of share €4), Earno ple invited its shareholders to subscribe to a 1 for 5 rights issue at €2 per share, calculate the basic EPS for both years.

(f) Diluted EPS.

(i) Another class of equity ranking for dividend in the future.

Assuming that on | January 2017, Earno plc had issued 10,000 ‘A’ ordinary shares, which though not ranking for dividend in the current period would do so subsequently, calculate the diluted EPS.

(ii) Convertible Securities.

Assume that on 31 March 2017, Earno plc issued €5,000 10% convertible debentures.

These were convertible into ordinary-shares as follows:

2017: 40 Ordinary Shares for €100 Convertible Debentures;

2018: 30 Ordinary Shares for €100 Convertible Debentures;

2019: 20 Ordinary Shares for €100 Convertible Debentures;

2020: 15 Ordinary Shares for €100 Convertible Debentures.

None of the debentures had been converted at 31 December 2017.

Calculate the diluted EPS (assume corporation tax @ 50%).

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly