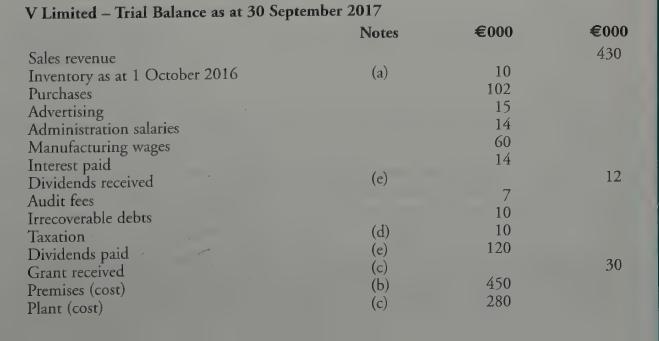

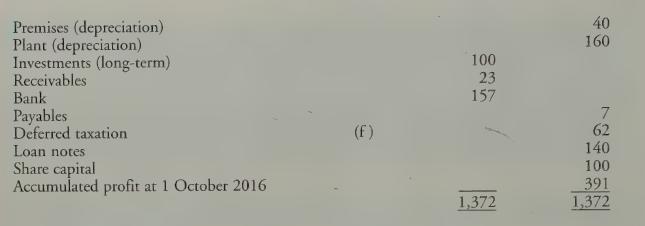

The following information relates to V Limited, a manufacturing company. Additional Information: (a) Inventory was worth 13,000

Question:

The following information relates to V Limited, a manufacturing company.

Additional Information:

(a) Inventory was worth 13,000 on 30 September 2017.

(b) Premises consist of land costing 250,000 and buildings costing 200,000. The buildings have an expected useful life of 50 years.

(c) Plant includes an item purchased during the year at a cost of 70,000. A government grant of 30,000 was received in respect of this purchase. These were the only transactions involving non-current assets during the year. Depreciation of plant is to be charged at 10% per annum on a straight-line basis.

(d) The balance on the tax account is an under-provision for tax brought forward from the year ended 30 September 2016.

(e) The company paid 48,000 on 27 November 2016 as a final dividend for the year ended 30 September 2016. A dividend of 12,000 was received on 13 January 2017 (record the 12,000 received with no adjustment). The 2017 interim dividend of 72,000 was paid on 15 April 2017.

(f) The provision for deferred tax is to be reduced by 17,000.

(g) The directors have estimated that tax of 57,000 will be due on the profits for this year.

(h) The directors have proposed a final dividend for the year of 50,000.

(i) It is company policy to charge depreciation to cost of sales.

Requirement:

Prepare a statement of profit or loss and other comprehensive income for V Limited for the year ended 30 September 2017 and a statement of financial position as at that date. These should be in a form suitable for presentation to the shareholders and be accompanied by notes to the accounts insofar as is possible from the information provided.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly