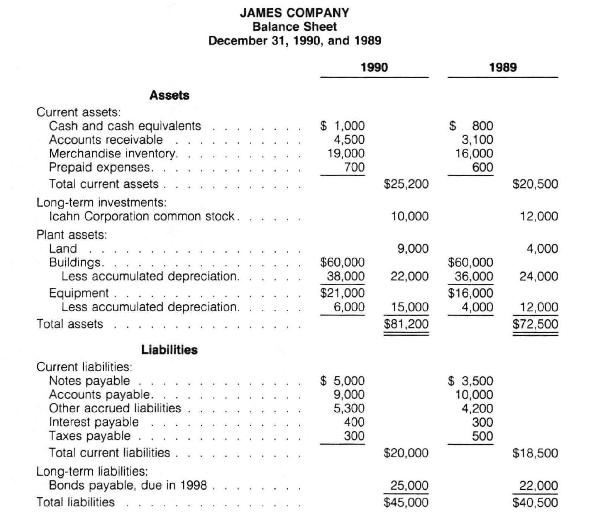

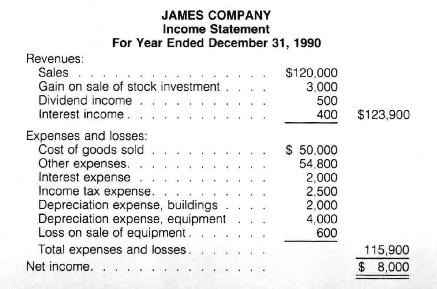

The following items include the 1990 and 1989 balance sheets and the 1990 income statement of the

Question:

The following items include the 1990 and 1989 balance sheets and the 1990 income statement of the James Company. Additional information about the company's 1990 transactions is presented after the financial statements.

Additional information:

1. Received \(\$ 5,000\) from the sale of Icahn Corporation common stock that originally cost \(\$ 2,000\).

2. Received a cash dividend of \(\$ 500\) from the Icahn Corporation.

3. Received \(\$ 400\) cash from the First National Bank on December 31, 1990, as interest income.

4. Sold old equipment for \(\$ 1,400\). The old equipment originally cost \(\$ 4,000\) and had accumulated depreciation of \(\$ 2,000\).

5. Purchased land costing \(\$ 5,000\) on December 31,1990 , in exchange for a note payable. Both principal and interest are due on June 30, 1991.

6. Purchased new equipment for \(\$ 9,000\) cash.

7. Purchased treasury stock for \(\$ 1,800\).

8. Paid off notes payable of \(\$ 3,500\).

9. Sold additional bonds payable at par of \(\$ 3,000\) on January 1, 1990 .

10. Issued 1,000 shares of common stock for cash at \(\$ 2\) per share.

11. Declared and paid a \(\$ 4,000\) cash dividend on October 1, 1990.

(The working papers that accompany the text include forms for this problem.)

\section*{Required}

a. Prepare a direct method working paper for James Company's 1990 statement of cash flows.

b. Prepare the statement of cash flows for 1990 .

c. Prepare a schedule that reconciles net income to the company's net cash provided (or used) by operating activities for 1990 .

Step by Step Answer: