The issued ordinary share capital of Weller plc (Weller) at 1 January 2016 was 6,000,000 ordinary shares

Question:

The issued ordinary share capital of Weller plc (“Weller”) at 1 January 2016 was 6,000,000 ordinary shares of €0.50 each. On 30 June 2017, Weller made a fully subscribed 1 for 3 rights issue at €1 per share, when the average price of one ordinary share was €1.50. There were no other changes to Weller’s ordinary share capital in 2016 and 2017. The average market price of one ordinary share in Weller during 2016 and 2017 was €1.20 and €1.60, respectively. At 31 December 2016 and 2017, Weller had a 5% loan of €1,000,000, which was convertible into 500,000 ordinary shares of €0.50 each. Weller pays corporation tax at 25%.

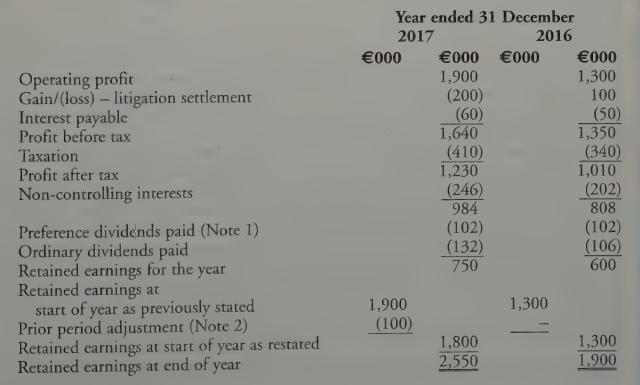

The following information is available from the statement of profit or loss and other comprehensive income and statement of changes in equity of Weller for the years ended 31 December 2016 and 2017.

Note 1: the preference dividends have not been charged in arriving at profit after tax in the oRLOG!I.

Note 2: the prior period adjustment relates to the discovery of a fundamental error in 2017, which would have affected Weller’s operating profit for the year ended 31 December 2016.

Requirement

(a) Calculate, in accordance with IAS 33 Earnings per Share:

(i) Weller’s basic EPS for the year ended 31 December 2016;

(ii) Weller’s diluted EPS for the year ended 31 December 2016;

(iii) Weller’s basic EPS for the year ended 31 December 2017;

(iv) Weller’s adjusted EPS for the year ended 31 December 2016 to be included as a comparative figure in Weller’s financial statements for the year ended 31 December 2017.

(b) Outline why it is considered important to measure EPS.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly