The purpose of this problem is to familiarize you with the financial statement information of a real

Question:

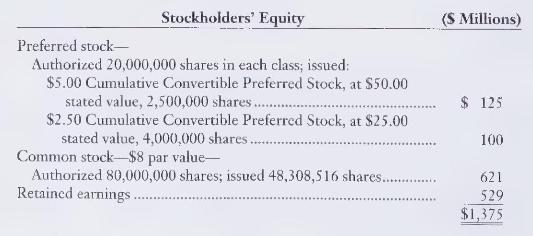

The purpose of this problem is to familiarize you with the financial statement information of a real company. Bethlehem Steel Corporation is one of the nation's largest steel companies. Bethlehem included the following stockholders' equity on its balance sheet:

Observe that Bethlehem reports no Paid-in Capital in Excess of Par or Stated Value. Instead, the company reports those items in the stock accounts.

\section*{Required}

1. Identify the different issues of stock Bethlehem has outstanding.

2. Which class of stock did Bethlehem issue at par or stated value, and which class did it issue above par or stated value?

3. Rearrange the Bethlehem Steel stockholders' equity section to correspond, as appropriate, to the terminology and format illustrated on page 575. Report dollar amounts in millions, as Bethlehem does.

4. Suppose Bethlehem passed its preferred dividends for one year. Would the company have to pay these dividends in arrears before paying dividends to the common stockholders? Give your reason.

5. What amount of preferred dividends must Bethlehem declare and pay each year to avoid having preferred dividends in arrears?

6. Assume preferred dividends are in arrears for 19X5.

a. Write Note 6 of the December 31, 19X5, financial statements to disclose the dividends in arrears.

b. Journalize the declaration of a \(\$ 60\) million dividend for \(19 \mathrm{X} 6\). An explanation is not required.

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.