Two companies that operate in the same industry as competitors are being evaluated by a bank that

Question:

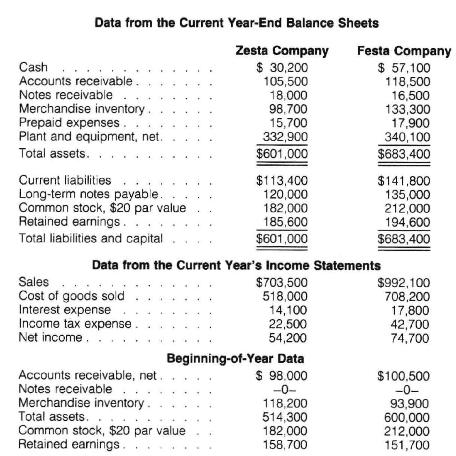

Two companies that operate in the same industry as competitors are being evaluated by a bank that may lend money to each one. Summary information from the financial statements of the two companies is provided on the next page:

\section*{Required}

1. Calculate current ratios, acid-test ratios, accounts (and notes) receivable turnovers, merchandise turnovers, and days' sales uncollected for the two companies. Then state which company you think is the better short-term credit risk and why.

2. Calculate profit margins, total asset turnovers, returns on total assets employed, and returns on common stockholders' equity. Assuming that each company paid cash dividends of \(\$ 3\) per share and each company's stock can be purchased at \(\$ 45\) per share, calculate price-earnings ratio and dividend yield. Also state which company's stock you would recommend as the better investment and why.

Problem 16-5A Analysis of working capital (L.O. 3)

Step by Step Answer: