Using the information provided in 29.20, assume the company faces three differing external environment scenarios: boom; steady

Question:

Using the information provided in 29.20, assume the company faces three differing external environment scenarios: boom; steady state; and recession. Each scenario has different income potentials: if there is a boom economy, then earnings before interest and taxation (EBIT) of £1 million are expected; if the economy stays steady, EBIT are expected to remain at £660,000; whereas if the economy goes into recession, EBIT are expected to fall to £450,000.

Data From 29.20

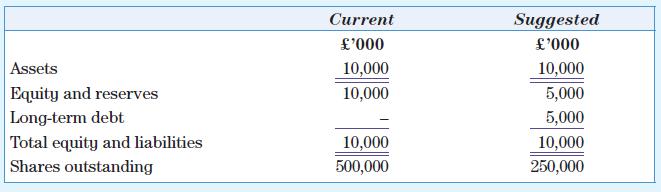

The directors of Atono plc were informed at a golf outing by fellow directors that it is more valuable to have debt in a company’s capital structure than equity, as debt is cheaper than equity. Atono plc currently has no debt in its capital structure, though is considering borrowing funds, which it will use to buy back the more expensive equity capital. The current and suggested capital structure of Atono plc is as follows:

Additional information:

1. The company’s equity shares are currently trading at £20 each, and it is assumed that this value does not change when the suggested capital structure change takes place.

2. The long-term debt attracts an interest rate of 8 per cent.

3. Taxation is 30 per cent.

Required

Calculate the impact of the change in gearing on the return on equity and the earnings per share for each scenario.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas