When his auditor arrived early in January to begin the annual audit, Sam Groves, the owner of

Question:

When his auditor arrived early in January to begin the annual audit, Sam Groves, the owner of Personal Sales, asked that careful attention be given to accounts receivable. Two things caused this request: (1) During the previous week, Mr. Groves had met Bob Peck, a former customer, and had asked him about his account which had recently been written off as uncollectible. Mr. Peck had indignantly replied that he had paid his \(\$ 425\) account in full, and he later produced canceled checks endorsed by Personal Sales to prove it. (2) The income statement prepared for the quarter ended the previous December 31 showed an unusually large volume of sales returns. The bookkeeper who had prepared the statement was a new employee, having begun work on October 1, after being hired on the basis of out-oftown letters of reference. In addition to doing all the record-keeping, the bookkeeper also acts as cashier, receiving and depositing the cash from both cash sales and those received through the mail.

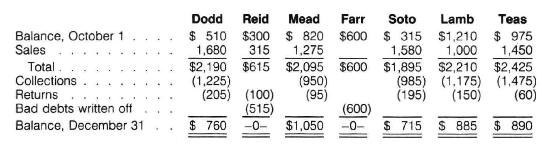

In the process of performing the audit, the auditor prepared from the company's records the following analysis of the accounts receivable for the period October 1 through December 31:

The auditor contacted all charge customers and learned that although their account balances as of December 31 agreed with the amounts shown in the company's records, the individual transactions did not. The customers reported credit purchases that totaled \(\$ 8,150\) during the three-month period and returns of \(\$ 305\) for which credit had been granted. Correspondence with Mr. Farr, the customer whose \(\$ 600\) account had been written off, revealed that he had become bankrupt and his creditor claims had been settled by his receiver in bankruptcy at \(\$ 0.25\) on the dollar. The checks had been mailed by his receiver on October 30, and all had been paid and returned by the bank, properly endorsed by the recipients.

Under the assumption the bookkeeper has embezzled cash from the company, determine the total amount he has taken and attempted to conceal with false accounts receivable entries. Account for the deficiency by listing the concealment methods used and the amount he attempted to conceal with each method. Also outline an internal control system that will help protect the company's cash from future embezzlement. Assume the company will hire a new bookkeeper, but that it is small and can have only one office employee who must do all the bookkeeping.

Step by Step Answer: