Xtra plc was incorporated in 1985 and makes up its accounts to 31 December each year. Its

Question:

Xtra plc was incorporated in 1985 and makes up its accounts to 31 December each year. Its main business is the hire and retail of videos, records, compact discs and computer games.

The company had traded very profitably throughout Ireland until the late 1990s when its results deteriorated dramatically as a result of fierce competition from larger retailers based in Great Britain entering the Irish market. In reaction to the falling profit margins and share price, the directors decided to try to halt the decline through a policy of acquisition and merger. The company has negotiated debt financing of up to €5 million at a fixed rate of 10% per annum with Allied North West Bank should it be required.

(a) During the second half of 2017 the directors of Xtra plc and VDO plc had discussions with a view to a combination of the two companies. As a result of these negotiations it was agreed that:

* on 31 December 2017 Xtra plc should acquire 1,440,000 of the issued ordinary shares of VDO plc;

° Xtra plc should pay cash of 12 cent for each VDO ple share, plus a one for one share exchange. At the date of the offer the market price of a share in Xtra ple was €1.20 per share and the market price of a share in VDO plc was €1.15 per share. Xtra ple shares had remained relatively stable at approximately €1.20 per share during 2017, whereas VDO ple shares had ranged from €1.10 to €1.35 per share. Before the offer neither company owned any shares in the other;

¢ the consideration would be increased by 144,000 shares ifa contingent liability in VDO plc in respect of a claim for wrongful dismissal by a former director did not crystallise.

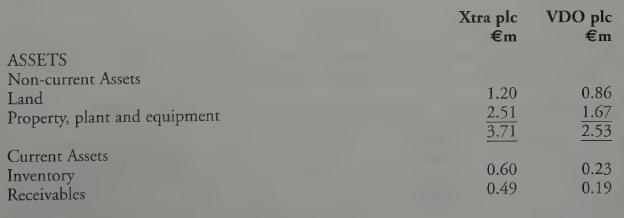

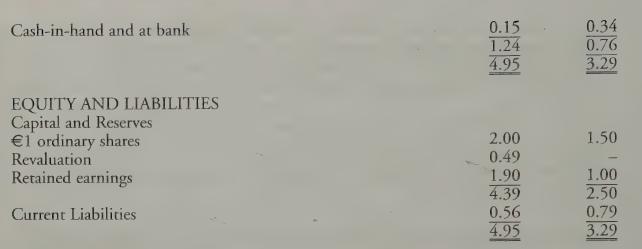

The summarised statements of financial position at 31 December 2017 of Xtra plc and VDO plc before the proposed combination were:

Additional Information:

1. The fair value of the assets of VDO plc at 31 December 2017 was:

Land €1.3m Property, plant and equipment €1.6m Inventory €0.2m Receivables €0.16m 2. With respect to the measurement of non-controlling interests at the date of acquisition, the proportionate share method equated to the fair value method.

Requirement

(a) Prepare the consolidated statement of financial position of Xtra ple and VDO ple.

(b) On 31 December 2017, Xtra plc acquired 90% of the ordinary shares of DAT Limited, a company involved in digital audio technology. While DAT Limited has suffered trading losses in recent years, the directors of Xtra plc are confident that, after incurring reorganisation costs of €250,000 and future trading losses of €150,000, DAT Limited will return to profit.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly