You are the accountant for Cocktail Group, which consists of three companies: Cocktail plc (Cocktail), Umbrella Limited

Question:

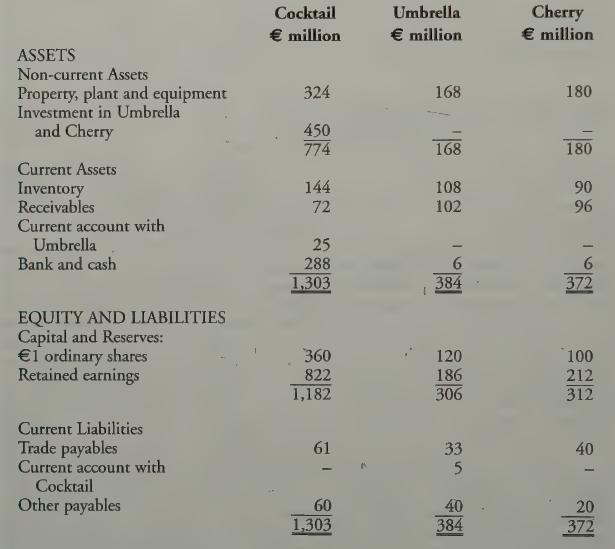

You are the accountant for Cocktail Group, which consists of three companies: Cocktail plc

(“Cocktail”), Umbrella Limited (“Umbrella”), and Cherry Limited (“Cherry”). The individual company statements of financial position as at 31 December 2017 are presented below.

Additional Information:

1. On 1 January 2013, Cocktail purchased 96 million €1 ordinary shares in Umbrella for €330 million. The retained earnings of Umbrella stood at €120 million on this date and property, plant and equipment with a remaining useful life of 10 years were recorded at €20 million less than their fair value. With respect to the measurement of non-controlling interests at the date of acquisition, the proportionate share method equates to the fair value method.

2. On 1 January 2017, Cocktail purchased 30 million €1 ordinary shares in Cherry for €120 million. The retained earnings of Cherry stood at €190 million on this date. The net assets of Cherry had a fair value that was the same as their book value.

. During 2017 Umbrella sold raw materials to Cocktail for €2 million, making a profit of 25% on cost. Cocktail paid for the raw materials on delivery, and had €500,000 of these in inventory at 31 December 2017.

. On 30 December 2017, Umbrella sent a cheque for €20,000,000 to Cocktail that was not received until 2 January 2018.

- The following proposed dividends, which had not been approved at the reporting date, are included in other payables at 31 December 2017:

€ million Cocktail 30 Umbrella 20 Dividends receivable by Cocktail from Umbrella are included in receivables.

. The directors of Cocktail estimate that the goodwill arising on the acquisition of Umbrella was impaired for the first time during the year ended 31 December 2017 by €61,000,000. It is group policy to charge a full year’s depreciation in the year of acquisition.

Requirement Prepare the consolidated statement of financial position for Cocktail Group as at 31 December 2017.

Note:

te a y The answer does NOT require a consolidated statement of profit or loss and other comprehensive income and statement of financial position in a form suitable for publication.

These statements may be presented by way of a consolidation schedule.

. Notes to the financial statements are NOT required, nor is a statement indicating the amount of profit dealt with in the parent company’s statement of profit or loss and other comprehensive income.

All workings should be clearly shown.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly