You are the financial accountant of Work plc (Work), a company that prepares its financial statements to

Question:

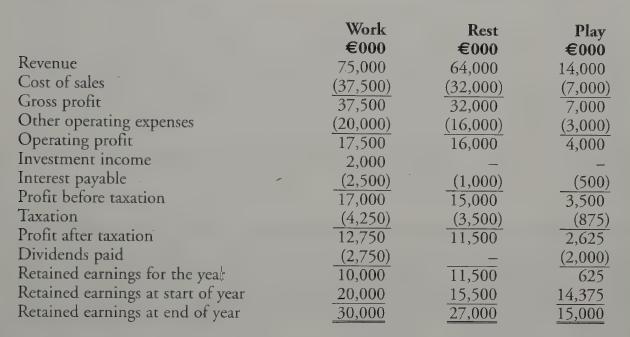

You are the financial accountant of Work plc (“Work”), a company that prepares its financial statements to 31 December each year. Work has investments in two companies, Rest Limited (“Rest”) and Play Limited (“Play”). The draft statements of profit or loss and other comprehensive income of these three companies for the year ended 31 December 2017 are as follows:

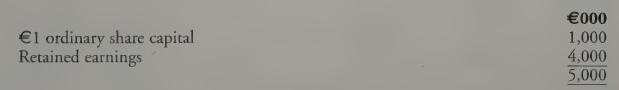

Additional Information: 5 1. On 1 January 2012, Work purchased 80% of the ordinary share capital of Rest for z €7,500,000. The fair value of the net assets of Rest was the same as their book value on that date. The statement of financial position of Rest on 1 January 2012 e showed:

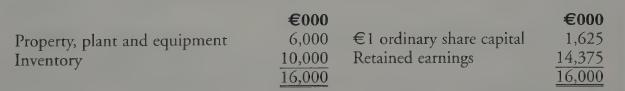

2. On 1 January 2017, Work purchased 100% of the ordinary share capital of Play for €10,500,000. The statement of financial position of Play on that date showed:

The fair value of the net assets of Play was the same as their book value on the acquisition date. Property, plant and equipment are depreciated over six years. During 2017, 50% of the inventory was sold outside the Group on normal trading terms, with the remaining inventory to be sold in 2018. ie 3. On 30 September 2017, Work disposed of the whole of its investment in Rest for €30,000,000. The taxation payable in connection with the disposal is €1,000,000.

The effect of the disposal has not yet been incorporated into the statement of profit or loss and other comprehensive income of Work. The activities of Rest are similar to Work and the directors of Work believe that the performance of the Group will not be materially affected following the disposal of Rest. (Note: the disposal of subsidiaries is dealt with in Chapter 32.)

4, During the year ended 31 December 2017, Play sold raw materials to Work at original cost plus a mark-up of 25%. At 31 December 2017, half of the raw materials sold to Work, at a cost of €120,000, remained in Work’s inventory.

5. Work charges Play a management fee of €50,000 per annum. The charge is included in the revenue of Work and the other operating expenses of Play.

6. There is no evidence that any goodwill arising on the acquisition of Rest and Play has ever been impaired.

Requirement Prepare the consolidated statement of profit or loss and other comprehensive income of the Work Group for the year ended 31 December 2017.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly