Zeppelin plc (Zeppelin) is an Irish company involved in the manufacture of aeroplanes for both private and

Question:

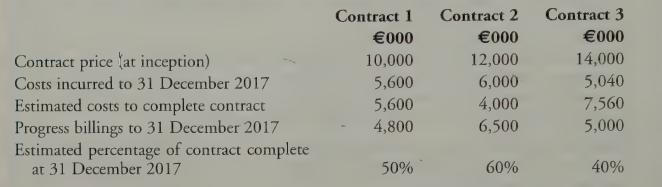

Zeppelin plc (“Zeppelin”) is an Irish company involved in the manufacture of aeroplanes for both private and commercial use. For internal reporting purposes, the company is divided into two cash-generating units (CGUs): Private and Commercial. During the year ended 31 December 2017, the Private CGU negotiated three separate fixed-price contracts to build a private jet for three wealthy football club owners. None of the contracts has a variable component and each is considered to contain only one performance obligation which will be satisfied over time. It has been determined that an input method that uses the percentage of completion based on costs incurred as a proportion of total estimated costs appropriately predicts performance under the contract. A loss-making contract can be deemed ‘onerous’ in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets, with the loss reflecting the least net cost of exiting from the contract.

Requirement Illustrate how each of the contracts negotiated by the Private CGU should be reflected in Zeppelin’s statement of profit or loss and other comprehensive income and statement of financial position for the year ended 31 December 2017.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly