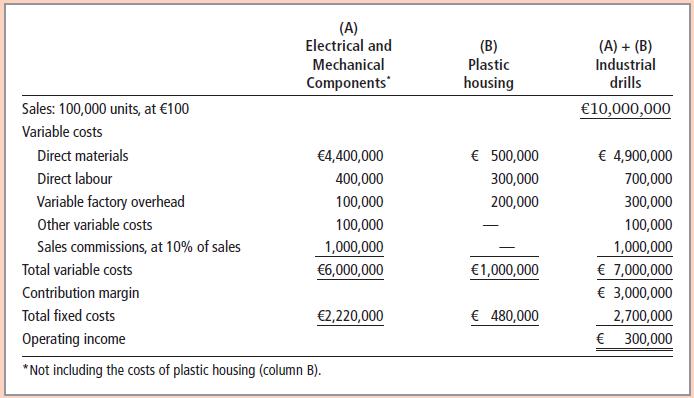

Exhibit 6.1 contains data for the Block Company for the year just ended. The company makes industrial

Question:

Exhibit 6.1 contains data for the Block Company for the year just ended. The company makes industrial power drills. Exhibit 6.1 shows the costs of the plastic housing separately from the costs of the electrical and mechanical components. Answer each of the following questions independently. (Requirement 1 reviews Chapter 5.)

Exhibit 6.1

1. During the year, a prospective customer in an unrelated market offered €82,000 for 1,000 drills. The drills would be manufactured in addition to the 100,000 units sold.

Block Company would pay the regular sales commission rate on the 1,000 drills. The president rejected the order because ‘it was below our costs of €97 per unit.’ What would operating income have been if Block Company had accepted the order?

2. A supplier offered to manufacture the year’s supply of 100,000 plastic housings for €12.00 each. What would be the effect on operating income if the Block Company purchased rather than made the housings? Assume that Block Company will avoid €350,000 of the fixed costs assigned to housings if it purchases the housings.

3. Suppose that Block Company could purchase the housings for €13.00 each and use the vacated space for the manufacture of a deluxe version of its drill. Assume that it could make 20,000 deluxe units (and sell them for €130 each in addition to the sales of the 100,000 regular units) at a unit variable cost of €90, exclusive of housings and exclusive of the 10 per cent sales commission. The company could also purchase the 20,000 extra plastic housings for €13.00 each. All the fixed costs pertaining to the plastic housings would continue because these costs relate primarily to the manufacturing facilities used. What would operating income have been if Block had bought the housings and made and sold the deluxe units?

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg