Malta Building Maintenance provides cleaning services for a variety of clients. The company has two producing divisions,

Question:

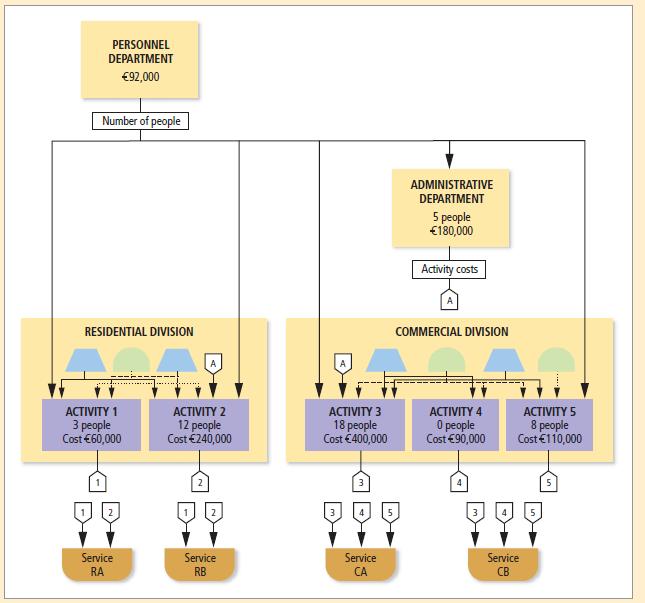

Malta Building Maintenance provides cleaning services for a variety of clients. The company has two producing divisions, residential and commercial, and two service departments, personnel and administrative. The company uses an activity-based allocation system in each of its producing divisions. Previously, the costs of service support departments have been unallocated.

However, the company has decided to allocate all service department costs to the producing departments’ personnel on the basis of number of employees and administrative on the basis of the direct costs of the activities in each division. Malta uses a process map as part of its activity-based allocation system. The map based on the budget for 20X5 is shown in Exhibit 12.23.

Exhibit 12.23

1. Determine the costs allocated to the residential and commercial divisions using the direct method.

2. Determine the costs allocated to the residential and commercial divisions using the stepdown method. The personnel department costs should be allocated first.

3. Explain how costs would be allocated to each customer in both the residential and commercial divisions.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg