Prepare a statement of estimated cash receipts and disbursements for October 20X7 for the Botanica Company, which

Question:

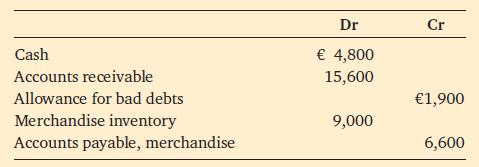

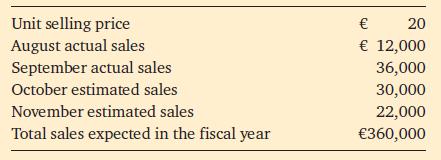

Prepare a statement of estimated cash receipts and disbursements for October 20X7 for the Botanica Company, which sells one product, herbal soap, by the case. On 1 October 20X7, part of the trial balance showed the following:

The company pays for its purchases within 10 days of purchase so assume that one-third of the purchases of any month are due and paid for in the following month.

The cost of the merchandise purchased is €12 per case. At the end of each month, it is desired to have an inventory equal in units to 50 per cent of the following month’s sales in units.

Sales terms include a 1 per cent discount if payment is made by the end of the calendar month. Past experience indicates that 60 per cent of sales will be collected during the month of the sale, 30 per cent in the following calendar month, 6 per cent in the next following calendar month and the remaining 4 per cent will be uncollectable. The company’s fiscal year begins 1 August.

Exclusive of bad debts, total budgeted selling and general administrative expenses for the fiscal year are estimated at €61,500, of which €24,000 is fixed expense (which includes a €13,200 annual depreciation charge). The Botanica Company incurs these fixed expenses uniformly throughout the year. The balance of the selling and general administrative expenses varies with sales. Expenses are paid as incurred.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg