Rosanne McIntire is a consultant to Georgia Paper Products Company. She is helping one of the companys

Question:

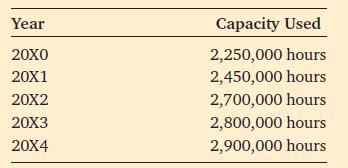

Rosanne McIntire is a consultant to Georgia Paper Products Company. She is helping one of the company’s divisions to install a standard cost system for 20X0. For product-costing purposes, the system must apply fixed factory costs to products manufactured. She has decided that the fixed-overhead rate should be based on machine hours, but she is uncertain about the appropriate volume to use in the denominator. Georgia Paper has grown rapidly; the division has added production capacity approximately every 4 years. The last addition was completed in early 20X0, and the total capacity is now 2,800,000 machine hours per year. McIntire predicts the following operating levels (in machine hours) through 20X4:

The current plan is to add another 500,000 machine hours of capacity in 20X4. McIntire has identified three alternatives for the application base:

(a). Predicted volume for the year in question.

(b). Average volume over the 4 years of the current production setup

(c) Practical (or full) capacity.

1. Suppose annual fixed factory overhead is expected to be €36,400,000 through 20X3. For simplicity, assume no inflation. Calculate the fixed-overhead rates (to the nearest cent) for 20X1, 20X2 and 20X3, using each of the three alternative application bases.

2. Provide a brief description of the effect of using each method of computing the application base.

3. Which method do you prefer? Why?

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg