The Plymouth Company differs from the Gibraltar Company (described in problem 13.55) in only one respect: it

Question:

The Plymouth Company differs from the Gibraltar Company (described in problem 13.55) in only one respect: it has both variable and fixed manufacturing costs. Its variable costs are €.14 per liter and its fixed manufacturing costs are €390,000 per year.

1. Using the same data as in the preceding problem, except for the change in production-cost behaviour, prepare three-column income statements for 20X0, for 20X1 and for the 2 years together using:

(a). Variable costing and

(b). Absorption costing.

2. What inventory costs would be carried on the balance sheets on 31 December 20X0 and 20X1, under each method?

Data from problem 13.55

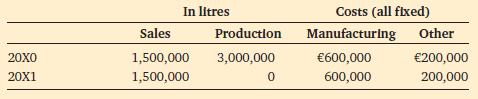

The Gibraltar Company has built a massive water-desalting factory next to an ocean. The factory is completely automated. It has its own source of power, light, heat and so on. The saltwater costs nothing. All producing and other operating costs are fixed; they do not vary with output because the volume is governed by adjusting a few dials on a control panel. The employees have flat annual salaries. The desalted water is not sold to household consumers. It has a special taste that appeals to local breweries, distilleries and soft-drink manufacturers. The price, €.60 per litre, is expected to remain unchanged for quite some time. The following are data regarding the first 2 years of operations:

Orders can be processed in 4 hours, so management decided, in early 20X1, to gear production strictly to sales.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg