Todmorden Tools Ltd makes tools and dies for industrial companies. The company has recently adopted a new

Question:

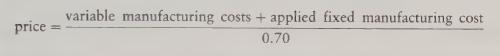

Todmorden Tools Ltd makes tools and dies for industrial companies. The company has recently adopted a new pricing policy that calls for pricing all products by the following formula:

Applied fixed manufacturing overhead is calculated at £8 per machine hour used for the product. This figure is based on budgeted fixed manufacturing costs of £1,200,000 and budgeted machine hours of 150,000. Dividing the total manufacturing cost by 70% provides an allowance for selling and administration expenses and for profit. Selling and administration expenses are budgeted at £745,000 fixed cost plus £0.08 per sales pound.

In general, variable manufacturing costs average £10 per machine hour, but that average does not apply to every product. Stocks are negligible.

Required

(a) Determine the profits that the company would earn at the following levels of machine hours:

(i) 140,000 (ii) 150,000 (iii) 160,000

(b) Suppose that the company has 160,000 machine hours available and more demand than it can satisfy. Its managers also believe that the profit calculated in part (a)(iii) above is a satisfactory target. However, they wonder whether the pricing formula will yield that profit if the mix of products changes so that variable manufacturing costs per machine hour change. Determine whether the policy would work if variable manufacturing costs dropped to an average of £8 per machine hour.

(c) Can you develop a formula that would yield the target profit no matter what variable manufacturing costs become? Assume that the company can get all the business it can handle at 160,000 machine hours. Remember that the company makes many different products, and you are developing a formula that should apply to any given product.

Step by Step Answer: