ABS Inc. produces air bag systems that it sells to North American automobile manufacturers. Although the company

Question:

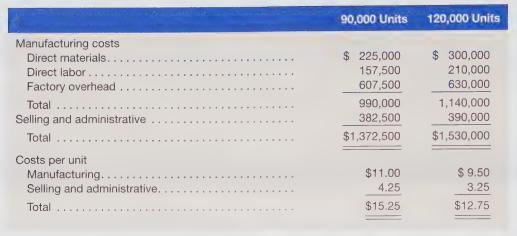

ABS Inc. produces air bag systems that it sells to North American automobile manufacturers. Although the company has a capacity of 150,000 units per year, it is currently producing at an annual rate of 90,000 units. ABS Inc. has received an order from a Japanese manufacturer to purchase 30,000 units at _ \($8.75\) each. Budgeted costs for 90,000 and 120,000 units are as follows:

Sales to North American manufacturers are priced at \($20\) per unit, but the sales manager believes the company should aggressively seek the Japanese business even if it results in a loss of \($4.00\) per unit.

She believes obtaining this order would open up several new markets for the company’s product. The general manager commented that the company cannot tighten its belt to absorb the \($120,000\) loss (\($4.00\) X 30,000) it would incur if the order is accepted.

Required

a. Determine the financial implications of accepting the order. (Hint: Use the high-low method to determine variable costs per unit.)

b. How would your analysis differ if the company were operating at capacity? Determine the advantage or disadvantage of accepting the order under full-capacity circumstances.

Step by Step Answer: