AccuMeter manufactures and sells its only product (Z1) in lot sizes of 500 units. Because of this

Question:

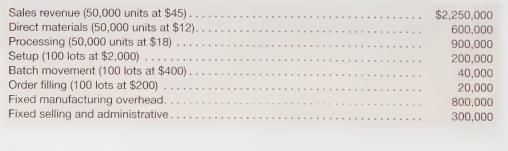

AccuMeter manufactures and sells its only product (Z1) in lot sizes of 500 units. Because of this approach, lot (batch)-level costs are regarded as variable for CVP analysis. Presented is sales and cost information for the year 2017:

Required

a. Prepare a traditional contribution income statement in good form.

b. Prepare a multi-level contribution income statement in good form. (Hint: First determine the appropriate cost hierarchy.)

c. What is the current contribution per lot (batch) of 500 units?

d. Management is contemplating introducing a limited number of specialty products. One product would sell for \($65\) per unit and have direct materials costs of \($17\) per unit. All other costs and all production and sales procedures will remain unchanged. What lot (batch) size is required for a contribution of \($700\) per lot?

Step by Step Answer: