Aerodec, Inc., manufactures and sells two types of wooden deck chairs: Deluxe and Tourist. Annual sales in

Question:

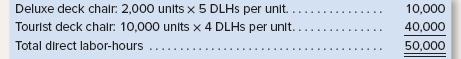

Aerodec, Inc., manufactures and sells two types of wooden deck chairs: Deluxe and Tourist. Annual sales in units, direct labor-hours (DLHs) per unit, and total direct labor-hours per year are provided below:

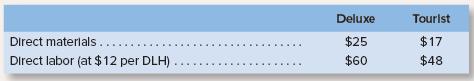

Costs for direct materials and direct labor for one unit of each product are given below:

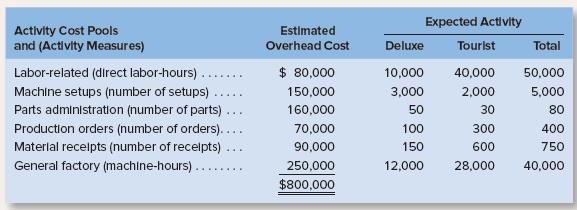

Manufacturing overhead costs total $800,000 each year. The breakdown of these costs among the company’s six activity cost pools is given below. The activity measures are shown in parentheses.

Required:

1. Classify each of Aerodec’s activities as either a unit-level, batch-level, product-level, or facility-level activity.

2. Assume that the company applies overhead cost to products on the basis of direct labor-hours.

a. Compute the predetermined overhead rate.

b. Determine the unit product cost of each product, using the predetermined overhead rate computed in (2)

(a) above.

3. Assume that the company uses activity-based costing to compute overhead rates.

a. Compute the activity rate for each of the six activities listed above.

b. Using the rates developed in (3)

(a) above, determine the amount of overhead cost that would be assigned to a unit of each product.

c. Determine the unit product cost of each product and compare this cost to the cost computed in (2)

(b) above.

Step by Step Answer:

ISE Introduction To Managerial Accounting

ISBN: 9781260091755

8th Edition

Authors: Peter Brewer, Ray Garrison, Eric Noreen