Capital Budgeting and ROI. Berman, Inc. has a division which performs telemarketing services for clients throughout the

Question:

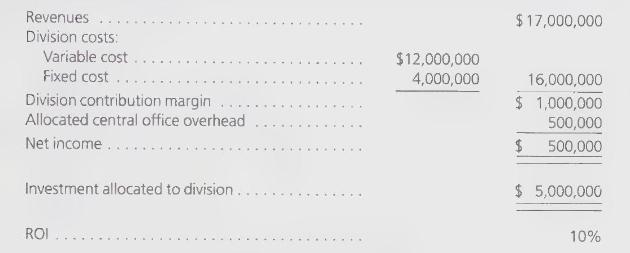

Capital Budgeting and ROI. Berman, Inc. has a division which performs telemarketing services for clients throughout the U.S. The income statement of this division is as follows:

The management is disturbed about the low ROI. The corporate treasurer indicates that the company can earn at least 20 percent on investment funds from any number of other projects. Furthermore, the treasurer points out that the investment is actually understated because an office building carried at a cost of \(\$ 5,000,000\) could be disposed of for about \(\$ 8,000,000\).

An investigation reveals that 50 percent of the division's fixed cost of \(\$ 4,000,000\) cannot be eliminated even if the division is sold. The allocated central office overhead is a pro-rata share of operating the corporate offices, and sale of the division would not affect this cost either.

\section*{Required:}

1. Assuming that an expenditure of \(\$ 1,000,000\) annually would maintain the facility in good operating condition for at least 10 years, should the division be sold? Explain.

2. If not, does a better way of reporting the ROI exist that would alert management to consider selling if volume begins to decline? Describe.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson