Capital investment analysis and decentralized performance measurement a comprehensive case.3 The following exchange occurred just after

Question:

Capital investment analysis and decentralized performance measurement — a comprehensive case.3 The following exchange occurred just after Diversified Electronics rejected a capital investment proposal.

Ralph Browning (Product Development): I j ust don't understand why you have rejected my proposal. This new investment is going to be a sure money maker for the Residential Products division. No matter how we price this new product, we can expect to make $230,000 on it before tax.

Sue Gold (Finance): I am sorry that you are upset with our decision, but this product proposal just does not meet our short-term ROI target of 15 percent after tax.

Browning: I'm not so sure about the ROI target, but it goes a long way toward meeting our earnings-per-share growth target of 20 cents per share after tax.

Phil Carlson (Executive Vice-President): Ralph, you are right, of course, about the importance of earnings per share. However, we view our three divisions as investment centers. Proposals like yours must meet our ROI targets. It is not enough that you show an earnings-per-share increase.

Gold: We believe that a company like Diversified Electronics should have a return on investment of 12 percent after tax, especially given the interest rates we have had to pay recently. This is why we have targeted 12 percent as the appropriate minimum ROI for each division to earn next year.

Carlson: If it were not for the high interest rates and poor current economic outlook. Ralph, we would not be taking such a conservative position in evaluating new projects. This past year has been particularly rough for our industry. Our two major competitors had ROIs of 10.8 percent and 12.3 percent. Though our ROI of about 9 percent after tax was reasonable (see Exhibit 12.9), performance varied from division to division. Professional Services did very well with 15 percent ROI, while the Residential Products division managed just 10 percent. The performance of the Aerospace Products division was especially dismal, with an ROI of only 6 percent. We expect divisions in the future to carry their share of the load.

Chris McGregor (Aerospace Products): My division would be showing much higher ROI if we had a lot of old equipment like Residential Products or relied heavily on human labor like Professional Services.

Carlson: I don't really see the point you are trying to make, Chris.

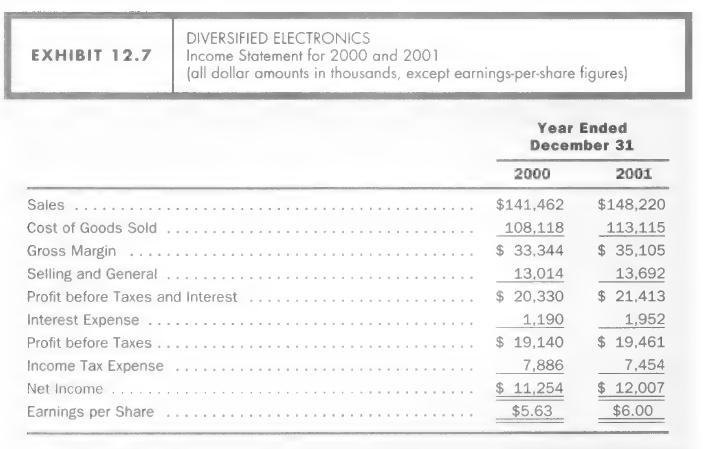

Diversified Electronics, a growing company in the electronics industry, had grown to its present size of more than $140 million in sales. (See Exhibits 12.7, 12.8, and 12.9 for financial data.) Diversified Electronics has three divisions, Residential Products, Aerospace Products, and Professional Services, each of which accounts for about one-third of Diversified Electronics' sales. Residential Products, the oldest division, produces furnace thermostats and similar products. The Aerospace Products division is a large job shop that builds electronic devices to customer specifications. A typical job or batch takes several months to complete. About one-half of Aerospace Products'

sales are to the U.S. Defense Department. The newest of the three divisions. Professional Services, provides consulting engineering services. This division has grown tremendously since Diversified Electronics acquired it 7 years ago.

Each division operates independently of the others and corporate management treats each as a separate entity. Division managers make many of the operating decisions.

Corporate management coordinates the activities of the various divisions, which includes review of all investment proposals over $400,000.

Diversified Electronics measures return on investment as the division's net income divided by total assets. Each division's expenses includes the allocated portion of corporate administrative expenses.

Since each of Diversified Electronics' divisions is located in a separate facility, management can easily attribute most assets, including receivables, to specific divisions.

Management allocates the corporate office assets, including the centrally controlled cash account, to the divisions on the basis of divisional revenues.

Exhibit 12.10 shows the details of Ralph Browning's rejected product proposal,

a. Why did corporate headquarters reject Ralph Browning's product proposal? Was their decision the right one? If top management used the discounted cash flow (DCF) method instead, what would the results be? The company uses a 15 percent cost of capital (i.e., hurdle rate) in evaluating projects such as these.

b. Evaluate the manner in which Diversified Electronics has implemented the investment center concept. What pitfalls did they apparently not anticipate? What, if anything, should be done with regard to the investment center approach and the use of ROI as a measure of performance?

c. What conflicting incentives for managers can occur between the use of a yearly ROI performance measure and DCF for capital budgeting?

Step by Step Answer:

Managerial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259630

7th Edition

Authors: Michael W. Maher, Clyde P. Stickney, Roman L. Weil, Sidney Davidson