Cash Flow From Divisions. Wear-Well Fabrics Company, Inc. operates with three divisions: an apparel division, a sports

Question:

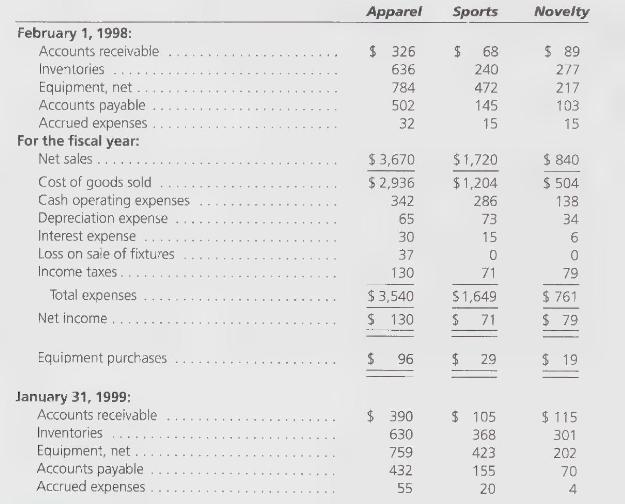

Cash Flow From Divisions. Wear-Well Fabrics Company, Inc. operates with three divisions: an apparel division, a sports division, and a novelty division. Each division is autonomous with a minimum of control exercised by the corporate headquarters. At the end of each fiscal year, divisions are expected to remit to corporate offices half of the cash flow generated by operations in that division. This requirement may be suspended if it can be shown that the funds are needed by the division for future operations.

Account balances (in thousands) traceable to each division as of February 1, 1998, for the fiscal year, and as of January 31, 1999, are:

\section*{Required:}

1. Prepare a statement that will show the cash flows from operations and investing for each division and for the company in total for the year.

2. Determine the amount to be remitted to corporate offices.

3. Comment on the possible impacts of this system of corporate cash control.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson