Question:

Catalina Inc. produces tents used for camping. The company expects to produce 8,320 units in the first quarter, 13,260 units in the second quarter, 15,080 units in the third quarter, and 11,260 units in the fourth quarter. With regards to direct materials, each unit of product requires 8 yards of material, at a cost of \($4\) per yard. Management prefers to maintain ending raw materials inventory equal to 15 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 14,000 yards. With regards to direct labor, each unit of product requires three labor hours at a cost of \($16\) per hour.

Required

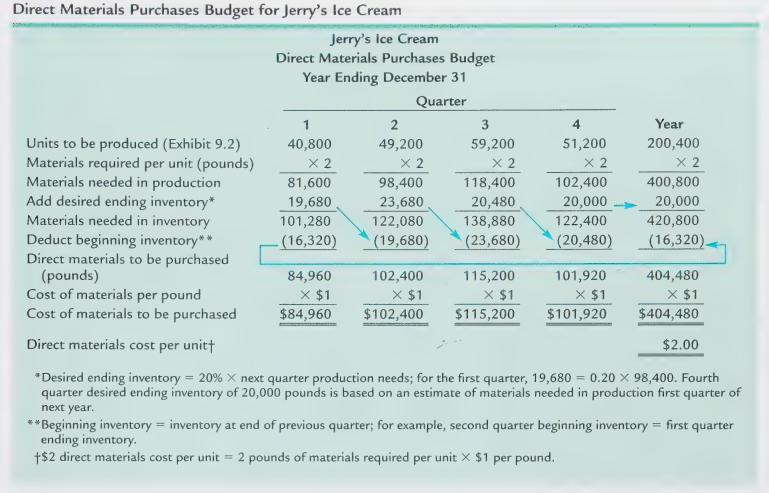

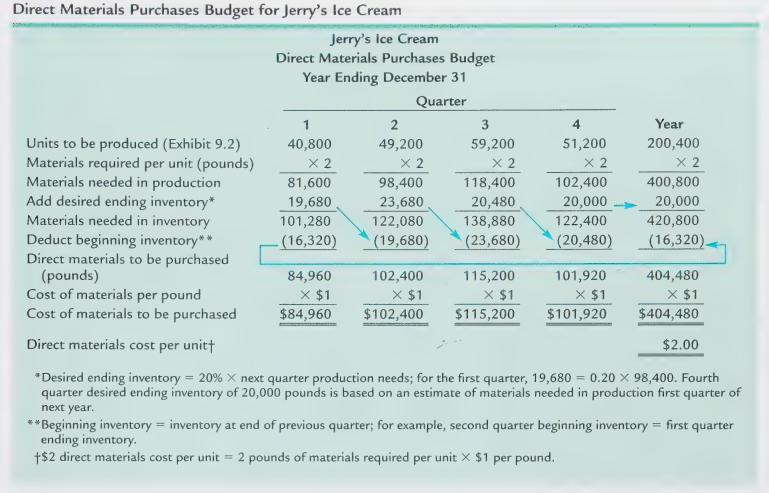

a. Prepare a direct materials purchases budget for Catalina Inc. using a format similar to Exhibit 9.3.

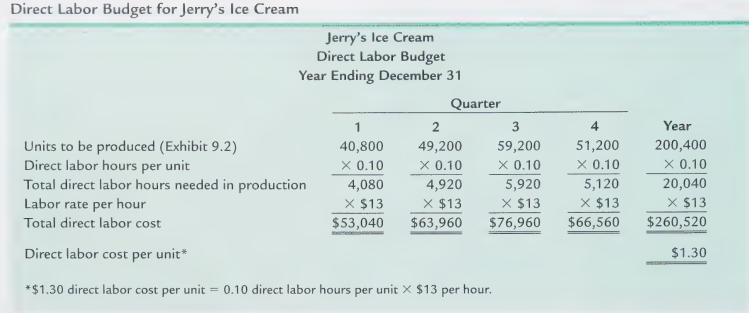

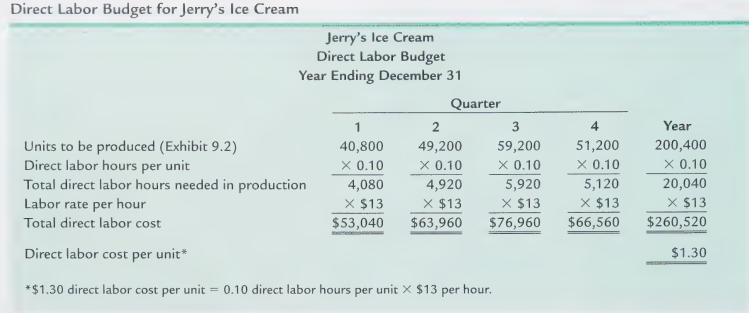

b. Prepare a direct labor budget for Catalina Inc. using a format similar to Exhibit 9.4.

Exhibit 9.3

Exhibit 9.4

Transcribed Image Text:

Direct Materials Purchases Budget for Jerry's Ice Cream Jerry's Ice Cream Direct Materials Purchases Budget Year Ending December 31 Quarter 1 2 3 Units to be produced (Exhibit 9.2) Materials required per unit (pounds) Materials needed in production Add desired ending inventory* 40,800 49,200 X 2 X 2 59,200 X 2 81,600 98,400 118,400 51,200 X 2 102,400 Year 200,400 X 2 400,800 19,680 23,680 20,480 20,000 20,000 Materials needed in inventory 101,280 122,080 138,880 122,400 420,800 Deduct beginning inventory** (16,320) (19,680) (23,680) (20,480) (16,320). Direct materials to be purchased (pounds) 84,960 102,400 115,200 101,920 404,480 Cost of materials per pound Cost of materials to be purchased X $1 $84,960 X $1 $102,400 X $1 $115,200 X $1 X $1 $101,920 $404,480 Direct materials cost per unit $2.00 *Desired ending inventory = 20% X next quarter production needs; for the first quarter, 19,680 = 0.20 98,400. Fourth quarter desired ending inventory of 20,000 pounds is based on an estimate of materials needed in production first quarter of next year. **Beginning inventory = inventory at end of previous quarter; for example, second quarter beginning inventory = first quarter ending inventory. +$2 direct materials cost per unit = 2 pounds of materials required per unit X $1 per pound.