. Comparing Alternatives. The Mohr Company is considering a new popper for one of its portable caramel...

Question:

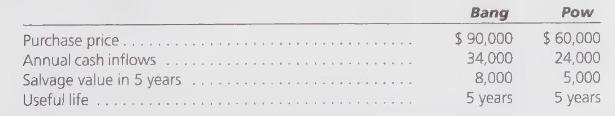

. Comparing Alternatives. The Mohr Company is considering a new popper for one of its portable caramel popcorn stands. The analysis is narrowed to the "Bang" or the "Pow." Information on the two devices is:

Either device will do the job equally as well. Mohr uses a 16 percent cost of capital. Ignore taxes.

\section*{Required:}

1. Which machine has the higher NPV?

2. Using the profitability index, which machine is more attractive?

3. If Mohr has \(\$ 180,000\) to invest in popping machines, what should it do? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson

Question Posted: