Cornerstone Bank paid ($120,000) for a check-sorting machine in January 2013. The machine had an estimated life

Question:

Cornerstone Bank paid \($120,000\) for a check-sorting machine in January 2013. The machine had an estimated life of 10 years and annual operating costs of \($110,000\), excluding depreciation. Although management is pleased with the machine, recent technological advances have made it obsolete. Consequently, as of January 2017, the machine has a book value of \($72,000\), a remaining operating life of 6 years, and a salvage value of $0.

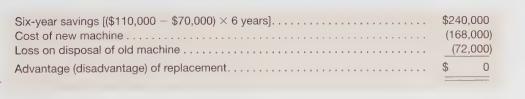

The manager of operations is evaluating a proposal to acquire a new optical scanning and sorting machine. The new machine would cost \($168,000\) and reduce annual operating costs to \($70,000\), excluding depreciation. Because of expected technological improvements, the manager believes the new machine will have an economic life of 6 years and no salvage value at the end of that life. Prior to signing the papers authorizing the acquisition of the new machine, the president of the bank prepared the following analysis:

After looking at these numbers, the manager rejected the proposal and commented that he was “tired of looking at marginal projects. This bank is in business to make a profit, not to break even. If you want to break even, go work for the government.”

Required

a. Evaluate the president’s analysis.

b. Prepare a differential analysis of six-year totals for the old and the new machines.

c. Speculate on some limitations of the model or other issues that might be a factor in making a final decision.

Step by Step Answer: