. Dropping a Product. Bob Leverenz, an old prospector, runs a side business. He buys rattlesnakes from...

Question:

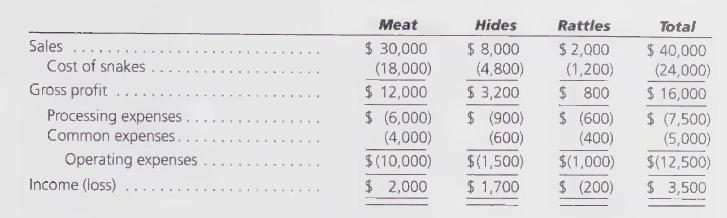

. Dropping a Product. Bob Leverenz, an old prospector, runs a side business. He buys rattlesnakes from "snake hunters" in west Texas, paying an average of \(\$ 10\) per snake. Each snake comes complete. He produces canned snake meat, cures hides, and makes souvenir rattles. At the end of a recent season, Bob is evaluating his financial results:

Cost of snakes assigned to each product is based on a ratio of cost to revenue. Processing expenses are direct costs. Common expenses are allocated on the basis of direct processing expenses and are Bob's basic living expenses. Bob has a philosophy of "every tub on its own bottom" and is determined to cut his losses on rattles.

\section*{Required:}

1. Is he really "losing" money on rattles? Explain.

2. An old miner has offered to buy every rattle "as is," without processing, for \(\$ 0.50\) per rattle. Will this eliminate the "loss" problem and improve Bob's profitability? Explain your reasoning.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson