Dropping Unprofitable Division Based on the following analysis of last years operations of Bingham, Inc., a financial

Question:

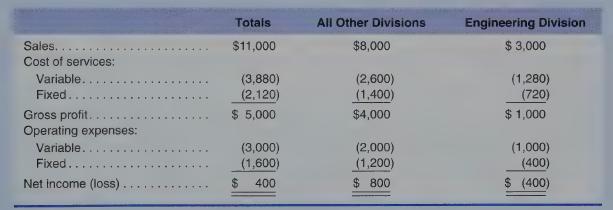

Dropping Unprofitable Division Based on the following analysis of last year’s operations of Bingham, Inc., a financial vice president of the company believes that the firm’s total net income could be increased by \($400,000\) if its engineering division were discontinued. (Amounts are given in thousands of dollars.)

Required

Provide answers for each of the following independent situations:

a. Assuming that total fixed costs and expenses would not be affected by discontinuing the engineering division, prepare an analysis showing why you agree or disagree with the vice president.

b. Assume that discontinuance of the engineering division will enable the company to avoid 40%

of the fixed portion of cost of services and 25% of the fixed operating expenses allocated to the engineering division. Calculate the resulting effect on net income.

c. Assume that in addition to the cost avoidance in requirement (b), the capacity released by discontinuance of the engineering division can be used to provide 6,000 new services that would have a variable cost per service of \($36\) and would require additional fixed costs totaling \($72,000.\)

At what unit price must the new service be sold if Bingham is to increase its total net income by \($120,000?\)

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9780357499948

2nd Edition

Authors: James Wallace, Scott Hobson, Theodore Christensen