During June 2019, its first month of operations, Logan Manufacturing Company completed the transactions listed below. Logan

Question:

During June 2019, its first month of operations, Logan Manufacturing Company completed the transactions listed below. Logan uses a job order costing system. Materials requisitions and the wages payable summary are analyzed on the 15th and the last day of each month, and charges for direct materials and direct labor are entered directly on specific job order cost sheets. Manufacturing overhead at the rate of 160% of direct labor costs is re- corded on individual job order cost sheets when a job is completed and at month-end for any job then in process. At month-end, entries to the general ledger accounts summarize materials requisitions, distribution of wages payable costs, and the application of manufacturing overhead for the month. All other entries to general ledger accounts are made as they occur.

1. Purchased materials on account, \($210,000\).

2. Paid miscellaneous manufacturing overhead costs, \($52,000\).

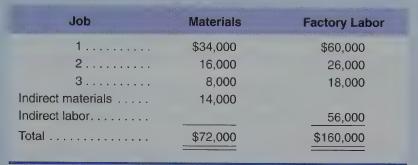

3. An analysis of materials requisitions and the wages payable summary for June 1-15 indicates the following cost distribution:

4. Jobs 1 and 2 were completed on June 15 and transferred to finished goods inventory on the next day. (Enter the appropriate manufacturing overhead amounts on the job order cost sheets, mark them completed, and make a general journal entry transferring the appropriate amount of cost to the Finished Goods Inventory account.)

5. Paid miscellaneous manufacturing overhead costs, \($38,000\).

6. Sold Job 1 on account, \($300,000\) (recognized its cost of sales in the general journal).

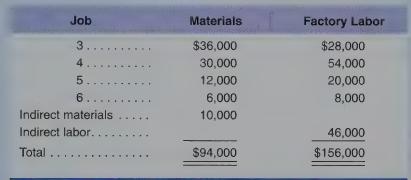

7. An analysis of materials requisitions and wages payable summary for June 16-30 indicates the following cost distribution:

8. Jobs 3 and 4 were completed on June 30 and transferred to finished goods inventory on the same day. (See transaction 4.)

9. Sold Job 3 on account, \($250,000\) (recognized its cost of sales in the general journal).

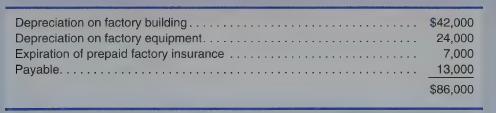

10. Recorded the following additional manufacturing overhead:

11. Recorded monthly general journal entry for the costs of all materials used.

12. Recorded monthly general journal entry for the distribution of wages payable costs.

13. Recorded manufacturing overhead on the job order cost sheets for jobs in ending work-in-process and in the general journal for all manufacturing overhead applied during the month.

Required

a. Set up the following general ledger T accounts: Materials Inventory, Wages Payable, Manufacturing Overhead, Work-in-Process Inventory, Finished Goods Inventory, Cost of Goods Sold, and Sales.

b. Set up T accounts for each of Jobs 1-6 as job order cost sheets. c. Noting the accounting procedures described in the first paragraph of the problem, do the following:

1. Record general journal entries for all transactions. Note that general journal entries are not required in transactions 3 and 7. Post only those portions of these entries affecting the gen- eral ledger accounts set up in requirement (a).

2. Enter the applicable amounts directly on the appropriate job order cost sheets for transactions 3, 4, 7, 8, and 13. Note parenthetically the nature of each amount entered.

d. Present a brief analysis showing that the general ledger accounts for work-in-process inventory and for finished goods inventory agree with the related job order cost sheets.

e. Explain in one sentence each what the balance of each general ledger account established in requirement (a) represents.

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9780357499948

2nd Edition

Authors: James Wallace, Scott Hobson, Theodore Christensen