Kielly Machines Inc. is planning an expansion program estimated to cost ($100) million. Kielly is going to

Question:

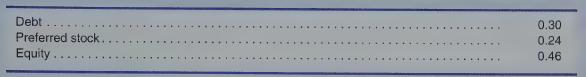

Kielly Machines Inc. is planning an expansion program estimated to cost \($100\) million. Kielly is going to raise funds according to its target capital structure shown below.

Kielly had net income available to common shareholders of \($184\) million last year of which 75% was paid out in dividends. The company has a marginal tax rate of 40%. Additional data:

• The before-tax cost of debt is estimated to be 11%.

• The market yield of preferred stock is estimated to be 12%.

• The after-tax cost of common stock is estimated to be 16%.

What is Kielly’s weighted average cost of capital?

a. 12222%

c. 13.54%

b. 13.00%

d. 14.00%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting For Undergraduates

ISBN: 9780357499948

2nd Edition

Authors: James Wallace, Scott Hobson, Theodore Christensen

Question Posted: