Knevil Equipment Company is planning to expand be- yond the industrial market of its materials handling equipment

Question:

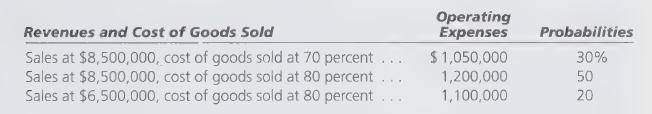

Knevil Equipment Company is planning to expand be- yond the industrial market of its materials handling equipment to produce trailers for the sports and recreation markets. The president, Spike Knevil, estimates that the company must invest $1,800,000 in new equipment up front. He wants to know how much cash flow can be provided by operations next year to apply toward acquiring the equipment and how much of the cost will have to be financed. His sales staff estimates revenue next year at $8,500,000. However, if eco- nomic conditions deteriorate, sales revenue may be only $6,500,000. Cost of goods sold has historically been 70 percent of revenue. A possibility exists that the company will have to absorb cost increases that cannot be passed along to customers. In this case, the cost of goods sold will be 80 percent of revenue. With sales down to $6,500,000, the cost of goods sold will definitely be 80 percent of revenue. Probabilities of occurrence have been estimated for each of three alternatives as follows:

Depreciation of $280,000 is included in operating expenses under each alter- native, and depreciation of $350,000 is included in cost of goods sold for each alternative. Income taxes are estimated at 40 percent of income before income taxes. In making the transition, equipment will be sold for $600,000, net of income taxes. A payment of $350,000 must be made on long-term notes payable. Spike wants dividends of $300,000 to be paid under each alternative.

Required:

1. What is the "worst case" cash-flow scenario that Spike could face?

2. Prepare a statement to show the forecast cash flow provided by operations under each assumption and the expected value of cash flows.

3. Continue the forecast statement to show how much additional cash will be needed to finance the new project after considering the information given. Show the impact of all three assumptions on expected cash flows.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson