Net Present Value and Expected Values. Two competing investment alternatives are being considered by the Mills Company.

Question:

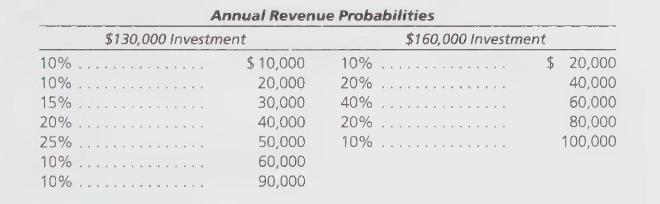

Net Present Value and Expected Values. Two competing investment alternatives are being considered by the Mills Company. One alternative costs \(\$ 130,000\). The other alternative costs \(\$ 160,000\). An investment of this type is expected to earn a discounted ROR of at least 14 percent. The two projects are each expected to last five years. Ignore taxes. Probabilities of annual revenues from each project differ as follows:

\section*{Required:}

Determine the more desirable alternative by the NPV method.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson

Question Posted: