Northwest Aircraft Industries (NAI) was founded 45 years ago by Jay Preston as a small machine shop

Question:

Northwest Aircraft Industries (NAI) was founded 45 years ago by Jay Preston as a small machine shop producing machined parts for the aircraft industry, which is prominent in the Seattle/Tacoma area of Washington. By the end of its first decade, NAI’s annual sales had reached $15 million, almost exclusively under government contracts. The next 30 years brought slow but steady growth as cost-reimbursement government contracts continued to be the main source of revenue. Realizing that NAI could not depend on government contracts for long-term growth and stability, Drew Preston, son of the founder and now president of the company, began planning for diversified commercial growth. As a result of these efforts, three years ago NAI had succeeded in reducing the ratio of government contract sales to 50 percent of total sales.

Traditionally, the costs of the Material-Handling Department have been allocated to direct material as a percentage of direct-material dollar value. This was adequate when the majority of the manufacturing was homogeneous and related to government contracts. Recently, however, government auditors have rejected some proposals, stating that “the amount of Material-Handling Department costs allocated to these proposals is disproportionate to the total effort involved.”

Kara Lindley, the newly hired cost-accounting manager, was asked by the manager of the Government Contracts Unit, Paul Anderson, to find a more equitable method of allocating Material-Handling Department costs to the user departments. Her review has revealed the following information.

• The majority of the direct-material purchases for government contracts are high-dollar, low-volume purchases, while commercial materials represent low-dollar, high-volume purchases

• Administrative departments such as marketing, finance and administration, human resources, and maintenance also use the services of the Material-Handling Department on a limited basis but have never been charged in the past for material-handling costs.

• One purchasing agent with a direct phone line is assigned exclusively to purchasing high-dollar, low-volume material for government contracts at an annual salary of $36,000. Employee benefits are estimated to be 20 percent of the annual salary. The annual dedicated phone line costs are $2,800.

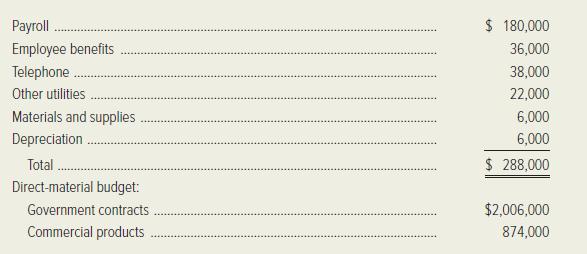

The components of the Material-Handling Department’s budget for 20x1, as proposed by Lindley’s predecessor, are as follows:

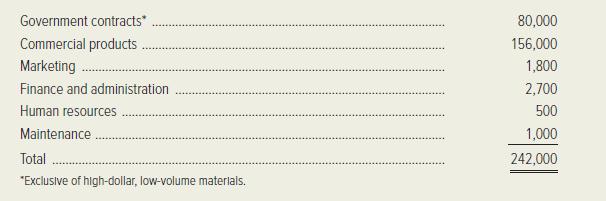

Lindley has estimated the number of purchase orders to be processed in 20x1 to be as follows:

Lindley recommended to Anderson that material-handling costs be allocated on a per-purchaseorder basis. Anderson realizes and accepts that the company has been allocating to government contracts more material-handling costs than can be justified. However, the implication of Lindley’s analysis could be a decrease in his unit’s earnings and, consequently, a cut in his annual bonus. Anderson told Lindley to “adjust” her numbers and modify her recommendation so that the results will be more favorable to the Government Contracts Unit.

Being new in her position, Lindley is not sure how to proceed. She feels ambivalent about Anderson’s instructions and suspects his motivation. To complicate matters for Lindley, Preston has asked her to prepare a three-year forecast of the Government Contracts Unit’s results, and she believes that the newly recommended allocation method would provide the most accurate data. However, this would put her in direct opposition to Anderson’s directives.

Lindley has assembled the following data to project the material-handling costs.

• Total direct-material costs increase 2.5 percent per year.

• Material-handling costs remain the same percentage of direct-material costs.

• Direct government costs (payroll, employee benefits, and direct phone line) remain constant.

• The number of purchase orders increases 5 percent per year.

• The ratio of government purchase orders to total purchase orders remains at 33 percent.

• In addition, she has assumed that government material in the future will be 70 percent of total material.

Required:

1. Calculate the material-handling rate that would have been used by Kara Lindley’s predecessor at Northwest Aircraft Industries.

2.

a. Calculate the revised material-handling costs to be allocated on a per-purchase-order basis.

b. Discuss why purchase orders might be a more reliable cost driver than the dollar amount of direct material.

3. Calculate the change in material-handling costs applied to government contracts by NAI as a result of the new cost assignment approach.

4. Prepare a forecast of the cumulative dollar impact over a three-year period from 20x1 through 20x3 of Kara Lindley’s recommended change for allocating Material-Handling Department costs to the Government Contracts Unit. Round all calculations to the nearest whole number.

5. Referring to the standards of ethical conduct for management accountants:

a. Discuss why Kara Lindley has an ethical conflict.

b. Identify several steps that Lindley could take to resolve the ethical conflict.

Step by Step Answer:

Managerial Accounting Creating Value In A Dynamic Business Environment

ISBN: 9781259569562

11th Edition

Authors: Ronald W.Helton, David E. Platt