. Proposal Preparation. Yoder Instruments Company manufactures a variety of products. The sales manager of Yoder, Dave...

Question:

. Proposal Preparation. Yoder Instruments Company manufactures a variety of products. The sales manager of Yoder, Dave Shockley, has stated repeatedly that he could sell more units of one of the firm's products if they were available. To prove his claim, the sales manager conducted a market research study last year at a cost of \(\$ 60,000\) to determine potential demand for this product. The study indicated that Yoder could sell 25,000 units annually for the next five years. A unit sells for \(\$ 20\) per unit.

The machinery currently used has capacity to produce 15,000 units annually. This machinery has a book value of \(\$ 80,000\) and a remaining useful life of five years. The salvage value of the machinery is negligible now and will be zero in five years. The variable production costs using this equipment are \(\$ 12\) per unit.

New machinery could produce 30,000 units annually. The new machinery costs \(\$ 250,000\) and has an estimated useful life of five years with no salvage value at the end of the five years. Yoder's production manager, Jean Smith, has estimated that the new equipment would provide increased production efficiencies, reducing the variable production costs to \(\$ 10\) per unit. She also explains that the machine's higher capacity would cause factory administrative overheads to be reallocated. She thought a charge of \(\$ 4\) per unit for the additional 10,000 units produced would be the amount calculated by the Cost Accounting Department.

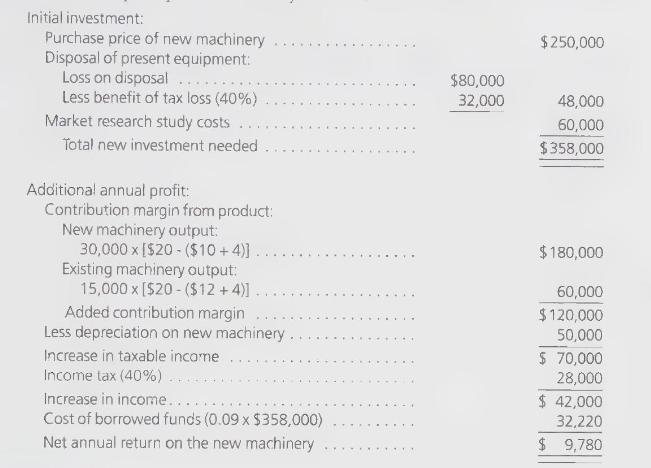

Dave Shockley felt so strongly about the additional capacity that he prepared an economic justification for the equipment. His analysis, which follows, excited him because it covered all expenses including the bank's 9 percent prime interest rate and "still returned a small sum to the bottom line." He was last seen on his way to the president's office to schedule a meeting with the executive finance committee. A quick peek at his analysis shows:

\section*{Required:}

Dave Shockley's executive secretary, who has kept him out of "hot water" in the past, is worried about his numbers. She asks you to evaluate his project numbers and see if he has his "gear together." You recall that the firm's cost of capital has been 16 percent, and tax rate is 40 percent. Straight-line depreciation is used. Revise the numbers as you feel necessary.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson