Raceway Engines, which builds high performance auto engines for race cars, started operations on January 1, 2017.

Question:

Raceway Engines, which builds high performance auto engines for race cars, started operations on January 1, 2017. During the month, the following events occurred:

Materials costing \($7,000\) were purchased on account.

Direct materials costing \($5,000\) were placed in process.

A total of 390 direct labor hours was charged to individual jobs at a rate of \($15\) per hour.

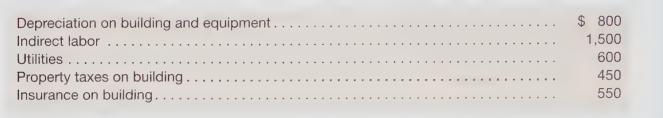

Overhead costs for the month of January were as follows:

On January 31, only one job (A06) was in process with materials costs of \($550\), direct labor charges of \($400\) for 30 direct labor hours, and applied overhead.

The building and equipment were purchased before operations began and the insurance was prepaid. All other costs will be paid during the following month.

Note: Predetermined overhead rates are used throughout the chapter. An alternative is to accumulate actual overhead costs for the period in Manufacturing Overhead, and apply actual costs at the close of the period to all jobs in process during the period.

Required

a. Assuming Raceway Engines assigned actual monthly overhead costs to jobs on the basis of actual monthly direct labor hours, prepare an analysis of Work-in-Process for the month of January.

b. Assuming Raceway Engines uses a predetermined overhead rate of \($10.50\) per direct labor hour, prepare an analysis of Work-in-Process for the month of January. Describe the appropriate treatment of any overapplied or underapplied overhead for the month of January.

c. Review the overhead items and classify each as fixed or variable in relation to direct labor hours.

Next, predict the actual overhead rates for months when 200 and 1,500 direct labor hours are used.

Assuming jobs similar to A06 were in process at the end of each month, determine the costs assigned to these jobs. (Hint: Determine a variable overhead rate.)

d. Why do you suppose predetermined overhead rates are preferred to actual overhead rates?

Step by Step Answer: