Redhawk Company has two manufacturing departmentsAssembly and Fabrication. The company considers all of its manufacturing overhead costs

Question:

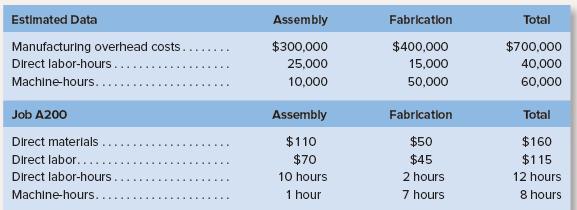

Redhawk Company has two manufacturing departments—Assembly and Fabrication. The company considers all of its manufacturing overhead costs to be fixed costs. The first set of data shown below is based on estimates that were made at the beginning of the year for the expected total output. The second set of data relates to one particular job completed during the year—Job A200.

Required:

1. If Redhawk uses a predetermined plantwide overhead rate with direct labor-hours as the allocation base, how much manufacturing overhead would be applied to Job A200?

2. If Redhawk uses predetermined departmental overhead rates with direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication, how much total manufacturing overhead cost would be applied to Job A200?

3. Assume that Redhawk uses the departmental overhead rates mentioned in requirement 2 and that Job A200 includes 50 units. What is the unit product cost for Job A200?

Step by Step Answer:

ISE Introduction To Managerial Accounting

ISBN: 9781260091755

8th Edition

Authors: Peter Brewer, Ray Garrison, Eric Noreen