Question:

Refer to the data in Exercise 13-15. Com¬ pute the following financial ratios for the year 2009:

Data From Exercise 13-15

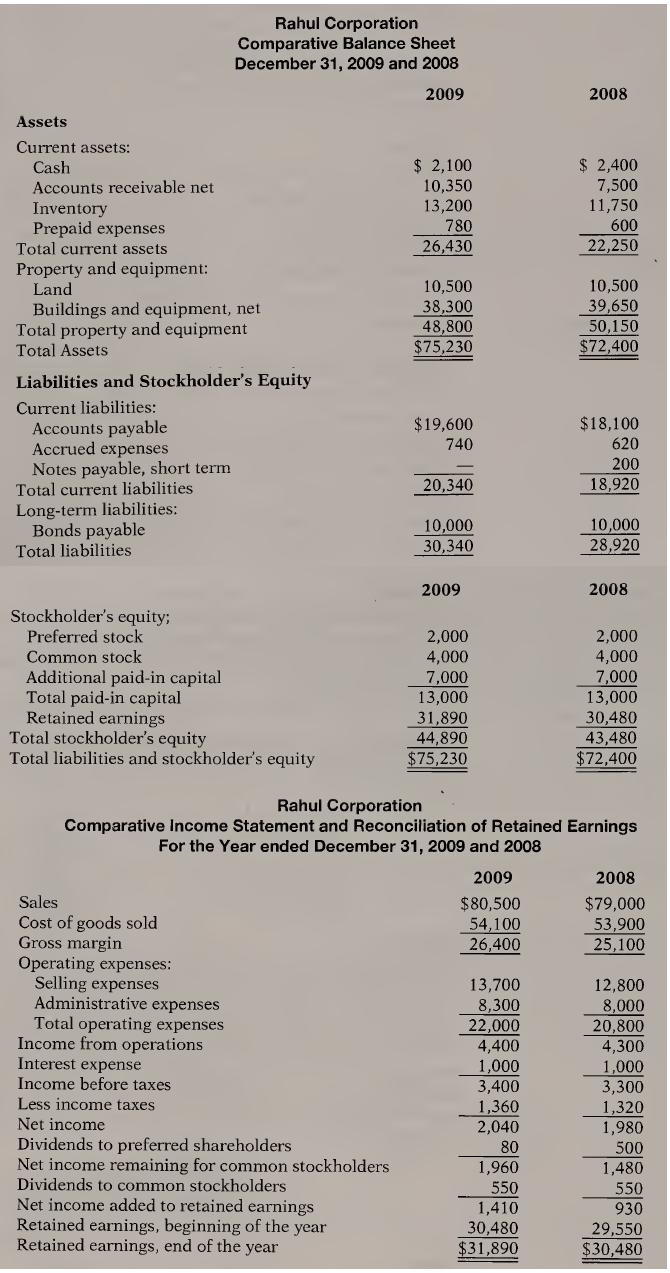

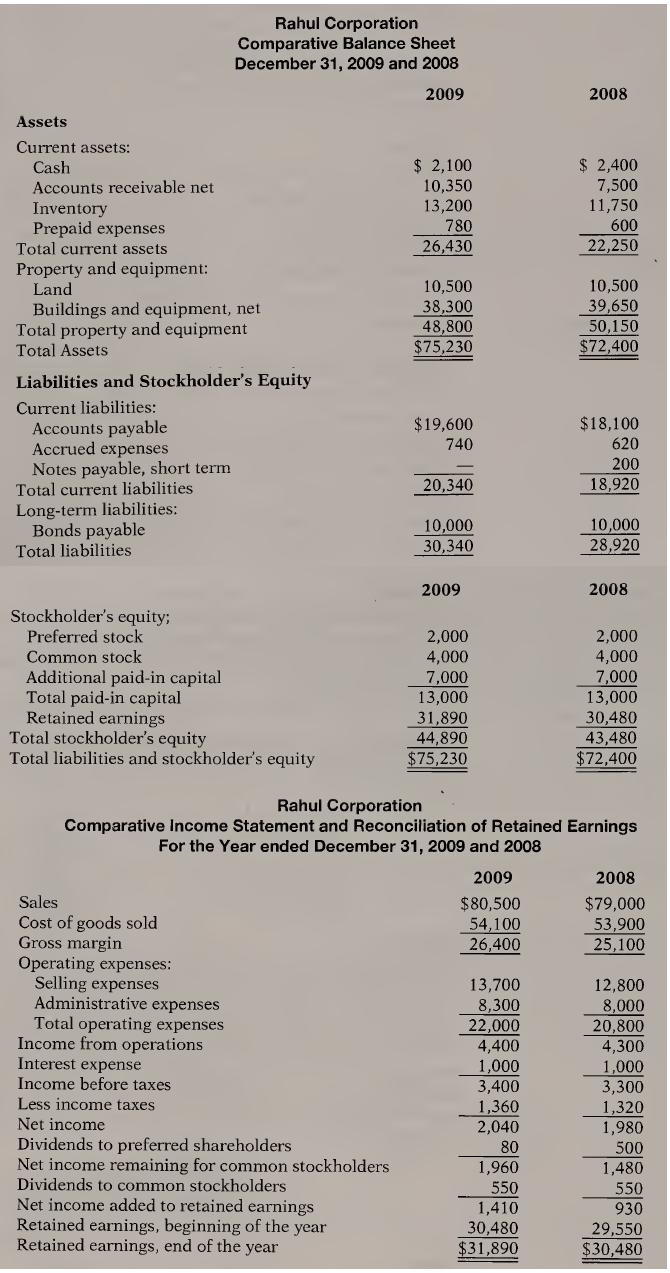

Comparative financial statements for the Rahul Corporation for the year ended December 31 are given below. A total of 500,000 shares of stock were outstanding. The market value of the company's stock at the end of the year was $25.

a. Current ratio.

b. Acid-test (Quick ratio).

c. Debt-to-equity ratio.

d. Times interest earned.

Comment on the results.

Transcribed Image Text:

Assets Current assets: Rahul Corporation Comparative Balance Sheet December 31, 2009 and 2008 2009 2008 Cash $ 2,100 $ 2,400 Accounts receivable net 10,350 Inventory Prepaid expenses Total current assets Property and equipment: 13,200 7,500 11,750 780 600 26,430 22,250 Land 10,500 10,500 Buildings and equipment, net 38,300 39,650 Total property and equipment 48,800 50,150 Total Assets $75,230 $72,400 Liabilities and Stockholder's Equity Current liabilities: Accounts payable $19,600 $18,100 Accrued expenses 740 620 Notes payable, short term 200 Total current liabilities 20,340 18,920 Long-term liabilities: Bonds payable Total liabilities 10,000 10,000 30,340 28,920 2009 2008 Stockholder's equity; Preferred stock Common stock Additional paid-in capital Total paid-in capital 2,000 2,000 4,000 4,000 7,000 7,000 13,000 13,000 Retained earnings Total stockholder's equity Total liabilities and stockholder's equity 31,890 30,480 44,890 43,480 $75,230 $72,400 Rahul Corporation Comparative Income Statement and Reconciliation of Retained Earnings For the Year ended December 31, 2009 and 2008 2009 2008 Sales Cost of goods sold Gross margin $80,500 $79,000 54,100 53,900 26,400 25,100 Operating expenses: Selling expenses Administrative expenses Total operating expenses Income from operations Interest expense Income before taxes 13,700 12,800 8,300 8,000 22,000 20,800 4,400 4,300 1,000 1,000 3,400 3,300 Less income taxes 1,360 1,320 Net income 2,040 1,980 Dividends to preferred shareholders 80 500 Net income remaining for common stockholders 1,960 1,480 Dividends to common stockholders 550 550 Net income added to retained earnings 1,410 930 Retained earnings, beginning of the year Retained earnings, end of the year 30,480 29,550 $31,890 $30,480