Sensitivity Analysis. Hillkirk-Lurie Corporation wants to expand a production facility because of increasing demand for its specialty

Question:

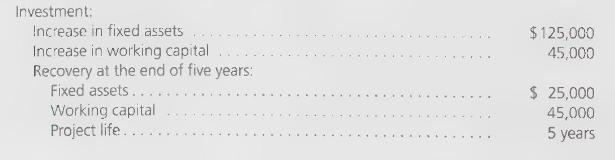

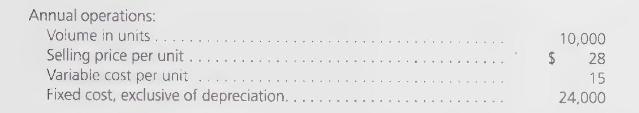

Sensitivity Analysis. Hillkirk-Lurie Corporation wants to expand a production facility because of increasing demand for its specialty line of cycling shorts. The following information is available for management's consideration in this decision:

Straight-line depreciation is used for tax purposes. Ignore salvage value and the half-year convention. The company's tax rate is 40 percent. On investments of this nature, the company uses a 15 percent aftertax ROR cutoff.

\title{

Required:

}

1. Determine the NPV of this investment proposal.

2. If variable costs are underestimated, by how much can the estimates be off and the investment still return 15 percent?

3. Holding costs and prices constant, by how much can unit volume fall and still have the firm earn 15 percent?

4. Given the original data, by how much can fixed costs increase (exclusive of depreciation on the new investment) and still have the project earn a 15 percent return?

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson