SolarTech, Inc., manufactures a special ceramic tile used as a component in residential solar energy systems. Sales

Question:

SolarTech, Inc., manufactures a special ceramic tile used as a component in residential solar energy systems. Sales are seasonal due to the seasonality in the home-building industry.

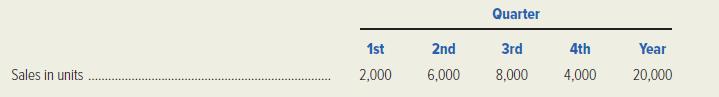

• The expected pattern of sales for the next year (20x8) is as follows:

• Each tile sells for $25. All sales are on account, and SolarTech’s experience with cash collections is that 60 percent of each quarter’s sales are collected during the same quarter as the sale.

The remaining 40 percent of sales is collected in the quarter after the sale. SolarTech experiences negligible bad debts, and so this is ignored in the budgeting process. Sales in the fourth quarter of 20x7 are expected to be $100,000 (4,000 units).

• SolarTech desires to have 10 percent of the following quarter’s sales needs in finished-goods inventory at the end of each quarter. (On December 31, 20x7, SolarTech expects to have 200 units in inventory.)

• Each tile requires two pounds of raw material. SolarTech desires to have 10 percent of the next quarter’s raw material in inventory at the end of each quarter. (On December 31, 20x7, SolarTech expects to have 480 pounds of raw material in inventory.)

• The raw material price is $5 per pound. The company buys its raw material on account and pays 70 percent of the resulting accounts payable during the quarter of the purchase. The remaining 30 percent is paid during the following quarter. (The raw-material purchases in the fourth quarter of 20x7 are expected to be $36,600.)

Required:

Prepare the following budget schedules for 20x8. Include a column for each quarter and for the year.

1. Sales budget (in units and dollars).

2. Cash receipts budget.

3. Production budget.

4. Direct material budget. (Hint: The desired ending inventory in the fourth quarter is 480 pounds.)

5. Cash disbursements budget for raw material purchases.

Step by Step Answer:

Managerial Accounting Creating Value In A Dynamic Business Environment

ISBN: 9781259569562

11th Edition

Authors: Ronald W.Helton, David E. Platt