Special order (CMA adapted). R.A. Ro operates a small machine shop. She manufactures one standard product, which

Question:

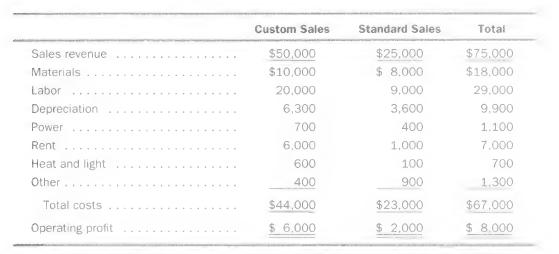

Special order (CMA adapted). R.A. Ro operates a small machine shop. She manufactures one standard product, which is available from many other similar businesses, in addition to custom-made products. Her accountant prepared the following annual income statement:

The depreciation charges are for machines (based on time) used in the respective product lines. The power charge is apportioned based on the estimate of power consumed.

The rent is for the building space, which has been leased for 10 years at $7,000 per year. The rent, heat, and electricity are apportioned to the product lines based on the amount of floor space occupied. All other costs are current expenses identified with the product line causing them.

A valued custom parts customer has asked R.A. to manufacture 10,000 special units. R.A. is working at capacity and would have to give up some other business to take this business. She can't renege on custom orders already agreed to, but she can reduce the output of her standard product by about one-half for one year while producing the custom part. The customer is willing to pay $7 for each unit.

Materials will cost about $2 per unit and the labor $3.60 per unit. R.A. will have to spend $2,000 for a special device, which will be discarded when the job is done.

Should R.A. take the order? Explain your answer.

Step by Step Answer:

Managerial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259630

7th Edition

Authors: Michael W. Maher, Clyde P. Stickney, Roman L. Weil, Sidney Davidson