Question:

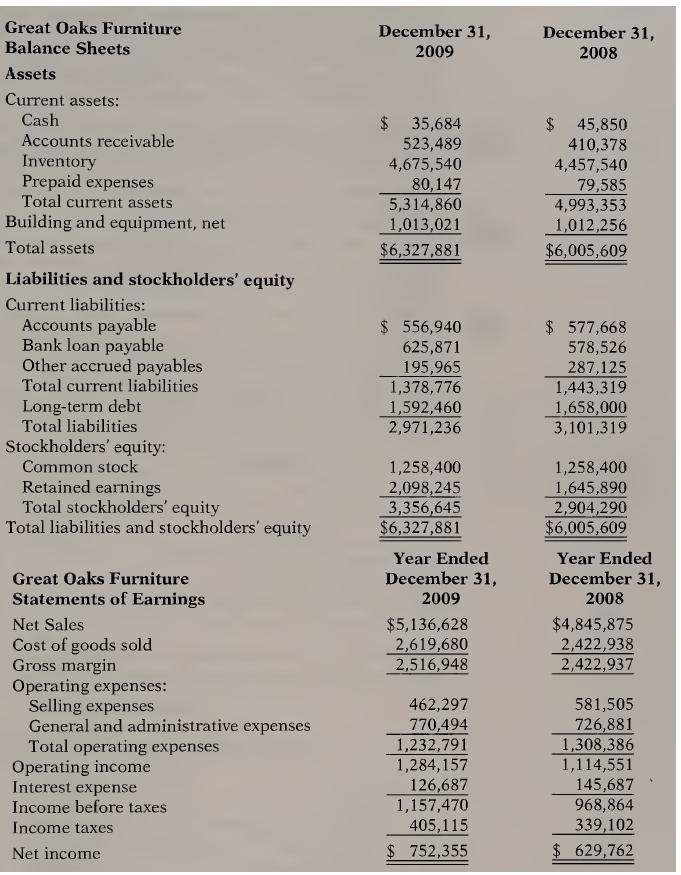

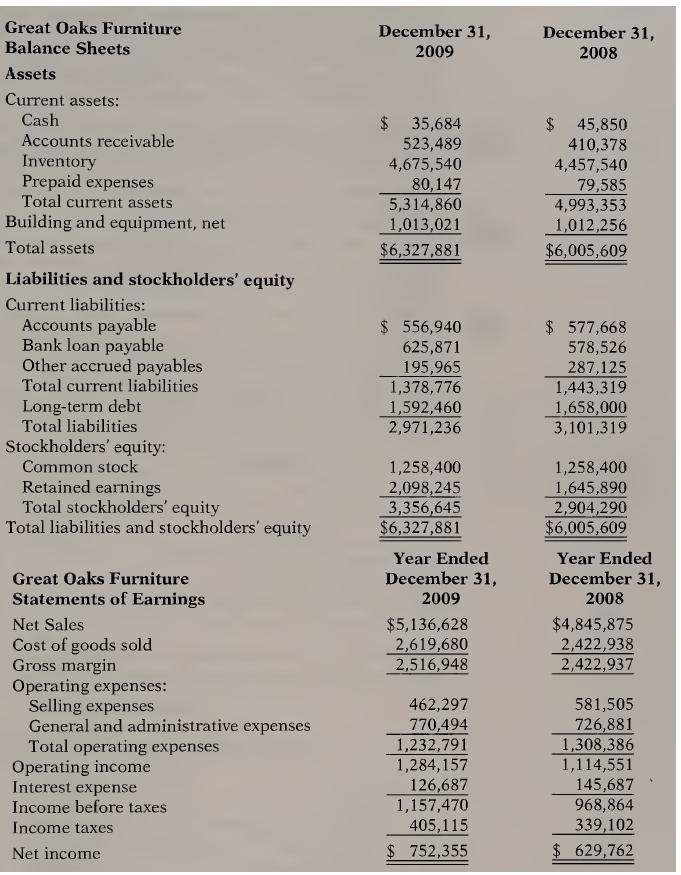

The following information for Great Oaks Furniture, a retail furniture and design firm, relates to Exercises 6 through 11.

Calculate the current ratio, the acid-test miam ratio, the debt-to-equity ratio and times interest earned for 2008 and 2009. Assume that Great Oaks Furniture was applying for a business loan and you are the loan officer. Do you have any concerns about lending them money?

Transcribed Image Text:

Great Oaks Furniture Balance Sheets Assets Current assets: Cash Accounts receivable Inventory Prepaid expenses Total current assets Building and equipment, net Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable Bank loan payable Other accrued payables Total current liabilities Long-term debt Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Great Oaks Furniture Statements of Earnings Net Sales December 31, 2009 December 31, 2008 $ 35,684 523,489 $ 45,850 410,378 4,457,540 4,675,540 80,147 79,585 5,314,860 4,993,353 1,013,021 $6,327,881 1,012,256 $6,005,609 $ 577,668 578,526 287,125 $ 556,940 625,871 195,965 1,378,776 1,443,319 1,592,460 1,658,000 2,971,236 3,101,319 1,258,400 1,258,400 2,098,245 1,645,890 3,356,645 2,904,290 $6,327,881 Year Ended December 31, 2009 $6,005,609 Year Ended December 31, 2008 $4,845,875 $5,136,628 Cost of goods sold 2,619,680 2,422,938 Gross margin 2,516,948 2,422,937 Operating expenses: Selling expenses 462,297 581,505 General and administrative expenses 770,494 726,881 Total operating expenses 1,232,791 1,308,386 Operating income 1,284,157 1,114,551 Interest expense 126,687 145,687 Income before taxes 1,157,470 968,864 Income taxes Net income 405,115 $ 752,355 $ 629,762 339,102