Transfer Price Based on Full Cost. The Casper Division of Freddie Company produces a large metal frame

Question:

Transfer Price Based on Full Cost. The Casper Division of Freddie Company produces a large metal frame which is sold to the Cody Division. Cody Division uses these frames in constructing metal lathes which are sold to machine tool manufacturers. In Casper Division, the frames are produced in a stamping process and are then run through a finishing process in which they are trimmed and polished before being shipped to the Cody Division.

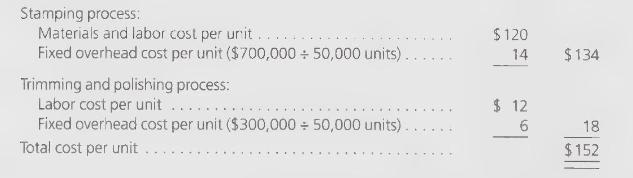

The current estimate of the variable costs of materials and labor to produce a frame in the stamping process is \(\$ 120\) per frame. Fixed overhead associated with this process in the Casper Division is \(\$ 700,000\) per year. Current production is 50,000 frames, which is full capacity for both the stamping and the trimming and polishing processes.

The variable cost of labor in the trimming and polishing process is \(\$ 12\) per frame since labor in this process is paid on a piece-rate basis. (No additional materials are required.) The fixed overhead in this process is \(\$ 300,000\) per year and is largely due to equipment depreciation and related costs. The machines have almost no salvage value because of their special-purpose design.

The transfer price to the Cody Division is a full-cost transfer price and is calculated by prorating the current fixed cost in each process over the 50,000 frames being produced. The price is quoted for each process and is presented to the manager as follows:

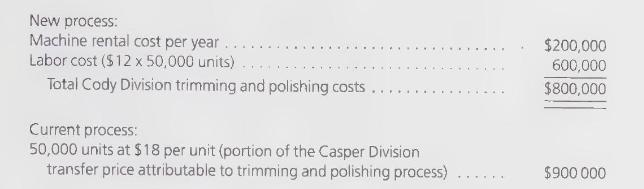

An outside company has offered to rent to Cody Division machinery which would perform the trimming and polishing process. The rental cost of the machinery is \(\$ 200,000\) per year. With the new machinery, the labor cost per frame would remain at \(\$ 12\). The Cody Division manager sees the possibility of obtaining the frames from the Casper Division for \(\$ 134\) by eliminating the \(\$ 18\) cost of trimming and polishing and of performing these processes in the Cody Division. An analysis is as follows:

The manager of the Cody Division has approached the vice-president of operations for approval to acquire the new machinery.

\section*{Required:}

1. As the vice-president, how would you advise the manager of the Cody Division?

2. Could the transfer pricing system be improved and, if so, how?

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson