Transfer Prices. Company Z operates in three countries, Countries A, B, and C. All company divisions sell

Question:

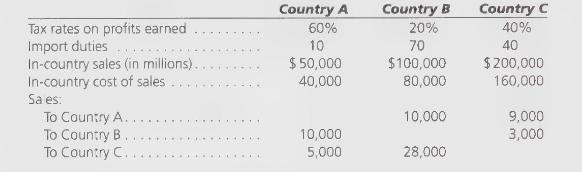

Transfer Prices. Company Z operates in three countries, Countries A, B, and C. All company divisions sell to other company divisions in the other two countries. The following is known about tax rates, import duties, and sales.

A number of assumptions must be made:

1. All intercompany sales figures include a 25 percent markup over costs. Also, variable costs are 40 percent of costs of sales for all sales.

2. Costs of sales does not include import duties.

3. Import duties are applied to the transfer price for imported goods.

4. Costs of imported goods are included in the costs of sales for each country. No inventories exist.

\section*{Required:}

The corporate controller of Company \(\mathrm{Z}\) is considering a change in intercompany sales pricing practices to minimize global taxes and duties. Assuming that the controller decides that all intercompany sales must show at least a 10 percent profit on variable costs, suggest a transfer price that will minimize global taxes and duties.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson