Upton, Inc. manufactures a line of home furniture. The company's single manufacturing plant consists of the Cutting,

Question:

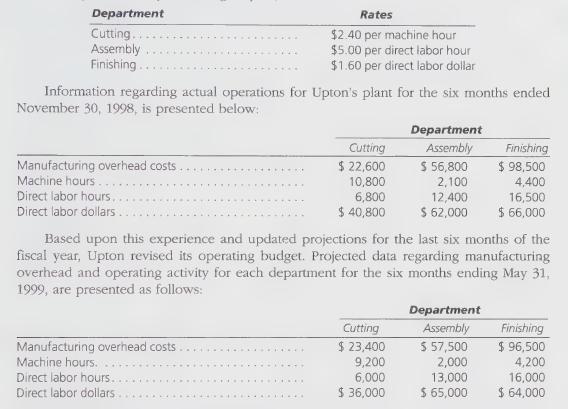

Upton, Inc. manufactures a line of home furniture. The company's single manufacturing plant consists of the Cutting, Assembly, and Finishing Departments. Upton uses depart- mental rates for applying manufacturing overhead to production and maintains separate manufacturing overhead accounts for each of the three production departments. The following predetermined departmental manufacturing overhead rates were calculated for Upton's fiscal year ending May 31, 1999:

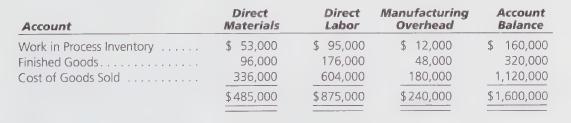

Diane Potter, Upton's controller, plans to develop revised departmental manufacturing overhead rates that will be more representative of efficient operations for the current fiscal year ending May 31, 1999. She has decided to combine the actual results for the first six months of the fiscal year with the projections for the next six months to develop revised departmental overhead rates. She then plans to adjust the manufacturing overhead ac- counts for each department through November 1998, to recognize the revised overhead rates. The following analysis was prepared by Potter from general ledger account balances as of November 30, 1998.

Required:

1. Determine the amount of manufacturing overhead applied as of November 30, 1998, before any revision for the:

(a) Cutting Department.

(b) Assembly Department.

(c) Finishing Department.

2. How should Upton, Inc. revise the departmental manufacturing overhead rates for the remainder of the fiscal year ending May 31, 1999? Show supporting calculations.

3. Prepare an analysis that shows how the manufacturing overhead applied should be adjusted as of November 30, 1998.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson