Variances for Individual Operating Expenses. Amia Manufacturing Company, a U. S. subsidiary of a British corporation, uses

Question:

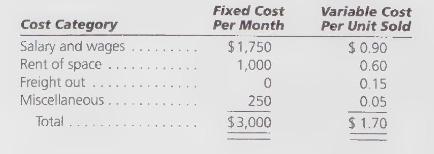

Variances for Individual Operating Expenses. Amia Manufacturing Company, a U. S. subsidiary of a British corporation, uses a budget formula for estimating its marketing and administrative expenses. The fixed and variable components of this formula for individual costs are:

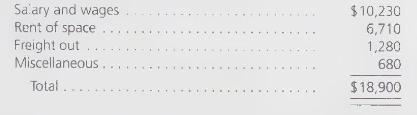

The subsidiary budgeted 10,000 units of sales for the month. Actually, 9,200 units were sold, and the following expenses were incurred:

At month end, numbers are sent to the home office in London for comparison and variance analysis. There, Siphiwe Mashinini, the corporate controller, oversees their translation into British pounds. The budgeted information is translated at the projected exchange rate \((\$ 1=£ 0.70)\). The actual amounts are translated at the actual end-of-month exchange rate \((\$ 1=£ 0.66)\).

\section*{Required:}

1. Ms. Mashinini has asked you to:

(a) Compute, for each of the individual cost categories, the spending and volume variances, and indicate whether they are favorable or unfavorable.

(b) Translate the subsidiary data according to home office policy.

2. What impact does the translation have on how you evaluate the spending and volume variances?

3. What is your suggestion for translating the numbers so the results of the translation will be evaluated the same as the U. S. dollar results?

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson